Reading Time: 4 minutes

Commercial Dump Truck Insurance Guide · U.S. Coverage & Cost

Updated: July 29, 2025 · Written by the Hotaling Team

Key Takeaways

-

Dump-truck insurance is mandatory for hauling gravel, soil, demolition debris or asphalt on public roads.

-

Standard policies bundle auto liability, physical damage, and cargo; optional add-ons cover environmental spills, debris removal, bobtail/non-trucking and more.

-

Average annual premium: $7,500–$13,000 per truck; rates depend on radius, location, driving record and telematics use.

-

DOT filings (MCS-90, BMC-91/91X, state forms) must stay active to avoid fines and out-of-service orders.

-

Hotaling Insurance partners with A-rated carriers (Chubb, Hartford, Travelers, Nationwide) and offers fleet-safety tools, ELD discounts and claims advocacy.

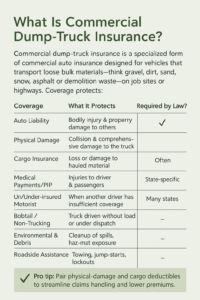

What Is Commercial Dump-Truck Insurance?

Download: What Is Commercial Dump-Truck Insurance?

Commercial dump-truck insurance is a specialized form of commercial auto insurance designed for vehicles that transport loose bulk materials—think gravel, dirt, sand, snow, asphalt or demolition waste—on job sites or highways. Coverage protects:

| Coverage | What It Protects | Required by Law? |

|---|---|---|

| Auto Liability | Bodily injury & property damage to others | ✅ |

| Physical Damage | Collision & comprehensive damage to the truck | — |

| Cargo Insurance | Loss or damage to hauled material | Often |

| Medical Payments/PIP | Injuries to driver & passengers | State-specific |

| Un/Under-insured Motorist | When another driver has insufficient coverage | Many states |

| Bobtail / Non-Trucking | Truck driven without load or under dispatch | — |

| Environmental & Debris | Cleanup of spills, haz-mat exposure | — |

| Roadside Assistance | Towing, jump-starts, lockouts | — |

Pro tip: Pair physical-damage and cargo deductibles to streamline claims handling and lower premiums.

How Much Does Dump-Truck Insurance Cost in 2025?

| Common Scenario | Avg. Monthly Premium | Key Rating Factors |

|---|---|---|

| Local gravel hauler – Houston | $650 | 50-mi radius, CDL 5 yr, 1 truck |

| Seasonal operator – Florida | $450 | Parked 3 mo/yr, low mileage |

| Interstate demo contractor – NY | $1,300+ | 300-mi radius, multi-state filings |

| 5-truck fleet – Austin | $525 / unit | ELD + dash-cam program |

Telematics savings: Installing an ELD with real-time driver-score monitoring can cut liability rates by 15-25 %. A $800/mo premium drops roughly $160, saving ≈$1,900/yr.

Typical Limits & Deductibles

| Coverage | Common Limit | Deductible Range |

|---|---|---|

| Auto Liability | $1 M CSL | $1k–$5k |

| Cargo | $100k–$250k | $2.5k–$5k |

| Physical Damage | Actual-cash or stated value | $1k–$2.5k |

| Environmental Liability | $25k–$100k | Carrier-specific |

ROI Table: Base Case vs Optimized Fleet Plan (3-Year View)

| Scenario | Year 1 Premium | Annual Savings | Total 3-Year Cost | Key Changes Applied |

|---|---|---|---|---|

| Base Case | $11,400 | — | $34,200 | No bundling, no telematics |

| Optimized (ELD + Bundling) | $8,950 | $2,450 | $26,850 | Telematics (-20%), multi-policy (-10%) |

| Optimized + Deductible Raise | $8,200 | $3,200 | $24,600 | Deductibles raised + fleet training |

Owner-Operators vs. Fleets — Coverage at a Glance

| Factor | Solo Owner-Op | Fleet Owner (2 – 40 units) |

|---|---|---|

| Policy structure | Individual truck policy | Fleet master policy |

| Primary rating factors | CDL tenure, radius, claims | Fleet loss ratio, SAFER score |

| Discounts | No-claims, CDL > 3 yr | Telematics, safety training, multi-policy |

| Support needs | 24/7 claims line | DOT audit prep, driver scorecards |

Who Are the Best Dump-Truck Insurance Carriers?

| Carrier | Ideal For | Stand-out Feature |

|---|---|---|

| Hartford | Small fleets, telematics adopters | SmartHaul® ELD discount |

| Chubb | High-value equipment | Agreed-value settlement, rapid claims |

| Travelers | Mixed-use owner-operators | Bundled filings, industry add-ons |

| Nationwide | Long-haul dump routes | Competitive cargo rates |

| Cincinnati | Multi-policy contractors | Integrated GL + auto programs |

| AIG | Environmental exposures | Spill & haz-mat specialist team |

How Hotaling helps: We pre-underwrite your fleet, shop multiple carriers, and negotiate endorsements before renewal to lock in the best rate.

How to Lower Your Premium in 2025

Download: How to Lower Your Premium in 2025

-

Adopt telematics (ELDs, dash cams) – up to 25% off liability.

-

Raise physical-damage deductibles – savings accelerate on older trucks.

-

Bundle with general liability/umbrella – 10-20% multi-policy discount.

-

Enroll drivers in CSA & OSHA training – many carriers apply “gold-tier” fleet credits.

-

Schedule quarterly safety reviews with your Hotaling advisor.

The Claims Process (Real-World Example)

Scenario: A tri-axle dump truck tips while backing down a residential drive, spilling 8 tons of gravel and cracking a retaining wall.

-

Driver calls 24/7 carrier hotline & Hotaling claims desk → file opened.

-

Adjuster dispatched within 24h for scene inspection & photos.

-

Repairs authorized; debris removed same day via specialty contractor.

-

Claim paid in 7–10 days: vehicle repairs, property damage, environmental cleanup.

-

Post-loss review with fleet manager → root-cause analysis, driver coaching.

State-Specific Premium Heat Map (Example)

| State | Avg. Monthly Premium | Unique Filing |

|---|---|---|

| Texas | $525 | DMV Form H |

| California | $1,100 | MCP-65 |

| Florida | $450 | No state add-on |

| New York | $1,300+ | NY HUT, NY DTF |

| Georgia | $625 | No unique forms |

Top 5 Red Flags That Spike Your Premium

Download: Top 5 Red Flags That Spike Your Premium

-

Radius > 300 miles — triggers interstate filings & higher liability exposure

-

Lapses in coverage history — auto-disqualification for most carriers

-

Poor SAFER score or inspection history

-

Drivers with < 3 years CDL experience

-

No telematics or dash cams in fleet

We Shop The Market for You. Here’s Some of Our Qualified Carriers

| Carrier | Best For | Strengths | Weaknesses |

|---|---|---|---|

| Hartford | Small, ELD-ready fleets | SmartHaul® discounts, strong safety tools | Slower claim onboarding |

| Chubb | High-value gear | Agreed-value, fast claim turnaround | Higher upfront premiums |

| Travelers | Mixed-use operators | Comprehensive filings, solid GL bundles | Moderate telematics discount |

| Nationwide | Long-haul carriers | Cargo-specific pricing, flexible terms | Average claims support speed |

| Cincinnati | Contractors w/ GL | Integrated packages across policies | Fewer digital tools |

⏱ Claims Speed Benchmark (Avg. Days to Payout)

| Carrier | Avg. Claim Payout Time | Notes |

|---|---|---|

| Hartford | 9 days | ELD files help speed up inspection |

| Chubb | 5–7 days | Dedicated adjusters, VIP claims support |

| Travelers | 10 days | Strong field response in urban markets |

| Nationwide | 11 days | Faster if bundled policy is in place |

FAQs

How much is dump-truck insurance per month?

Most owner-operators pay $625–$1,300, driven by radius, truck value and loss history.

Do I need special filings to haul interstate?

Yes—FMCSA requires MCS-90 and BMC-91/BMC-91X; some states add NY HUT or KYU.

Can I bundle dump-truck, GL and workers’ comp?

Absolutely. Bundling can trim 15–20 % and simplify renewals.

What is environmental liability insurance?

It pays for cleanup, third-party damage and fines after fuel, asphalt or debris spills.

Do telematics really lower rates?

Most A-rated carriers give 10–25 % credits for ELD, dash-cam or driver-score programs.

Ready to Protect Your Dump-Truck Fleet?

Hotaling Insurance matches contractors and fleet owners with the right carrier, coverage and compliance support—so you stay on the road, on budget and in full DOT compliance.

Hotaling Insurance — Building safer fleets since 1992.

Fill out the form below and well get back to you as soon as possible.