Florida’s Hurricane Season: Insurance Insights

Introduction

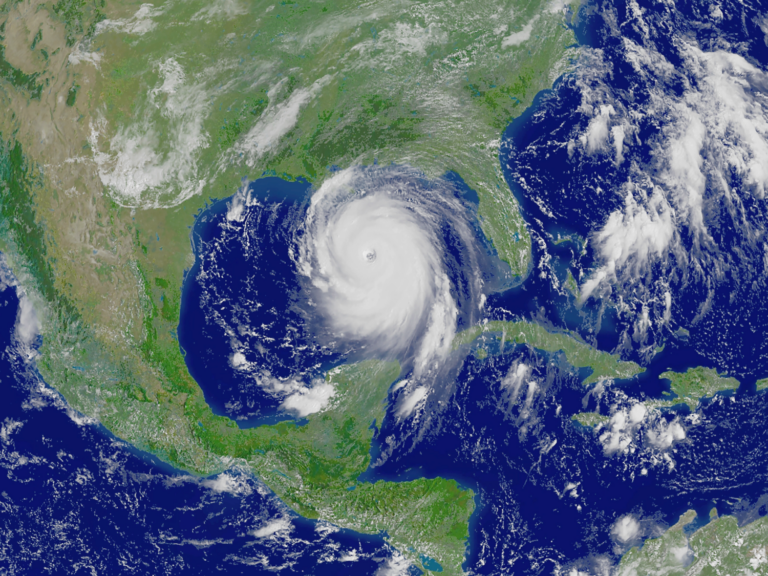

Florida’s hurricane season is a critical time for both preparation and reflection on the vital role of insurance in safeguarding personal and business interests against the unpredictability of nature. From June to November, residents and businesses brace for the potential devastation that hurricanes can bring, emphasizing the importance of comprehensive insurance coverage that addresses unique needs during these tumultuous months. This article explores the intricate effects of hurricanes on various aspects of life and property, and how tailored insurance services can mitigate these impacts effectively.

Case Study: Insurance Innovations and Strategies During Hurricane Season

Client Background

Our client is a prominent insurance provider based in Florida, specializing in comprehensive coverage solutions for homeowners and businesses. With a vast clientele spread across hurricane-prone areas, the company is deeply invested in enhancing its service offerings to meet the unique demands of its policyholders during the turbulent hurricane seasons.

Problem

The client faced significant challenges in managing the surge in insurance claims that typically follows a hurricane. The process was often slow and cumbersome, leading to delays in disbursing payments and increased dissatisfaction among policyholders. Moreover, assessing the extent of damages physically was not only time-consuming but sometimes delayed further due to accessibility issues in the aftermath of a storm.

Solution

To address these issues, the client adopted a two-pronged approach:

- Incorporation of Drone Technology: The client introduced the use of drones to perform rapid and accurate assessments of damage soon after a hurricane. This technology allowed for quicker surveying of affected areas, particularly those that were hard to reach due to debris or flooding. By using drones, the company could gather detailed visual data, enabling them to assess claims more efficiently and expedite the claims process.

- Community-Based Preparedness Programs: Recognizing the importance of proactive measures, the client also launched educational programs aimed at preparing communities for hurricane season. These programs focused on informing residents about the best insurance practices, the importance of timely policy reviews, and how to secure their properties against upcoming storms. This initiative not only helped in mitigating damage during hurricanes but also streamlined the claims process by reducing the incidence of severe losses.

What’s New: Impact of Hurricanes on Insurance Premiums and Coverage

Updated Insights: Impact of Hurricanes on Insurance Premiums and Coverage

The relationship between hurricane activity and the dynamics of insurance costs is increasingly critical, especially for hurricane season in states like Florida. Hurricanes have a substantial impact on insurance premiums, primarily due to the extensive property damage they cause, which in turn elevates the risk profile for insurers. Following significant hurricanes, insurance companies often reassess their risk models and adjust premiums accordingly to account for the heightened risk of future losses. This adjustment is a direct response to the financial strain that insurers face following major storm events, which often result in billions in insured losses.

For instance, Hurricane Idalia, despite being one of the few significant hurricanes in 2023, led to estimated insured losses of $3-5 billion. The aftermath of such events typically sees insurers recalibrating premiums to manage future risks more effectively. Moreover, as the climate continues to change, the frequency and intensity of hurricanes are expected to increase, further compounding the risks and potential losses. This scenario forces insurers to continually adapt by modifying coverage terms and premium rates to sustain their economic viability while still providing necessary coverage options (PolicyGenius) (Moody’s RMS).

In Florida, the situation is exacerbated by the state’s position as a hurricane hotspot, which has led to it experiencing some of the highest insurance premiums in the country. These premiums are rising faster than in any other state, driven by the increasing regularity and severity of hurricane hits combined with a home insurance market crisis where many insurers are opting to limit coverage or exit the state altogether (PolicyGenius).

Overall, understanding these changes and their implications is essential for homeowners and businesses to ensure they remain adequately protected against the evolving risk landscape. This knowledge enables policyholders to make informed decisions about their insurance needs, balancing cost with coverage in a state that is no stranger to the ravages of nature.

Impact of Hurricanes Across Sectors and Insurance Implications

Marine Ecosystems

Insurance for marine and coastal properties needs to account for the ecological damage caused by hurricanes, which can affect property values and long-term viability.

Urban Planning and Infrastructure

Robust urban planning and strict building codes help mitigate risks, potentially lowering insurance costs for well-prepared areas.

Agriculture

Specialized insurance products are essential for farms to cover crop destruction and livestock loss, crucial for maintaining economic stability after a storm.

Renewable Energy

As installations like solar farms and wind turbines are prone to hurricane damage, tailored renewable energy insurance policies are vital.

Psychological Impact

Comprehensive health insurance that includes mental health services can be a lifeline for individuals affected by the trauma of hurricanes.

Technology and Communication Infrastructure

Florida hurricane season can severely disrupt technological and communication networks, leading to extensive service downtimes. Insurance policies tailored for technology companies and telecom operators often include coverage for equipment damage and loss of income due to network outages. Ensuring robust insurance plans helps these sectors quickly restore services, which is crucial for emergency responses and community recovery.

Hospitality and Tourism

The hospitality and tourism industry is particularly vulnerable to hurricanes, which can cause significant property damage and lead to a steep decline in tourist arrivals. Insurance solutions for this sector typically focus on property damage, business interruption, and liability coverage. These policies help hotels, resorts, and other tourism-related businesses recover from immediate losses and assist in managing cancellations and reduced bookings during peak hurricane season.

Public Health Infrastructure

Hospitals and healthcare facilities have faced unique challenges during Florida hurricane season, including physical damage to facilities and the need for rapid response to public health emergencies. Insurance for healthcare facilities not only covers physical damages but also accommodates the costs associated with emergency preparedness, such as stocking up on supplies and securing backup power sources. This coverage is critical for maintaining healthcare services during and after hurricanes.

Retail and Supply Chain

Retail businesses and supply chains can be disrupted by hurricanes, affecting both inventory and the ability to operate. Insurance in this sector is designed to cover loss of goods, damage to physical stores, and economic loss due to halted operations. Additionally, supply chain insurance can provide coverage for businesses that suffer indirect effects from hurricane damage, such as delayed deliveries and broken supply lines.

Education Institutions

Schools and universities must also prepare for the impacts of hurricanes. Insurance coverage for educational institutions includes property damage to buildings and content, data loss (for digital educational resources), and interruption of operations. Furthermore, schools often invest in additional coverage for emergency evacuation and temporary relocation of students and staff if necessary.

Conclusion on Sector-Specific Insurance Needs

Each of these sectors requires a thoughtful approach to insurance, taking into account the unique risks posed by hurricanes. By tailoring insurance products to the specific needs and risks of different industries, businesses can ensure a faster and more efficient recovery process, minimizing the long-term impacts of hurricane-related disruptions.

FAQs on Hurricane Insurance in Florida

- How do hurricanes affect insurance premiums in Florida? Typically, after significant hurricane activity, insurance premiums can rise as insurers adjust to increased risk.

- What insurance coverage is essential for hurricane season in Florida? Property damage coverage, flood insurance, and business interruption insurance are crucial.

- What steps can I take to lower my insurance costs in hurricane-prone areas? Enhancing your home or business’s hurricane preparedness, such as installing impact-resistant windows and reinforced roofing, can help reduce premiums.

- What should I look for in an insurance policy to ensure adequate coverage for hurricanes? Policies should cover a range of damages, including wind, water, and personal property losses, with clear terms on claim processes and deductibles.

Florida Hurricane Season: Conclusion

As we navigate Florida’s hurricane season, the right insurance coverage stands as our primary defense against the financial repercussions of hurricanes. At Hotaling Insurance Services, we are dedicated to providing our clients with personalized advice and the most comprehensive coverage options available. With over a decade of expertise and a commitment to our community, we ensure you are well-prepared to face any storm with confidence and security.

For more information on how you can get real protection contact us here for a comprehensive policy that’s made in your best interest here.