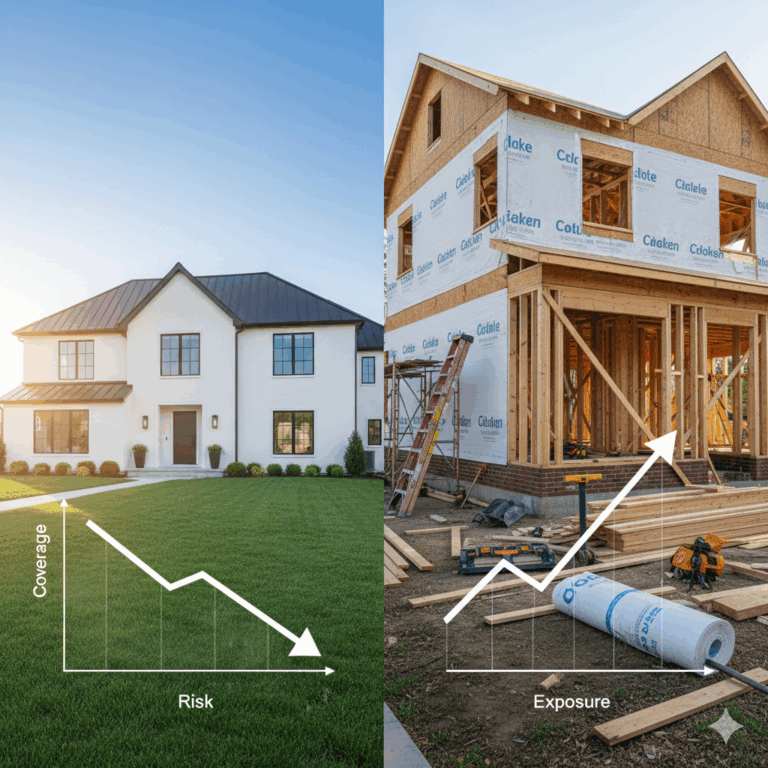

Homeowners Insurance Rate Increases 2025: How New Construction Beats 27% Premium Spikes

SEO Title: Homeowners Insurance Rate Increases 2025: New Construction Savings Guide Meta Description: Homeowners insurance rate increases 2025 hit 27% in some states. Discover how new construction homes avoid premium spikes, save $1,000+ annually, and beat inflation through smart coverage strategies.

Last Updated: October 16, 2025

With homeowners insurance premiums rising 8% nationally in 2025—and spiking 27% in Louisiana and 21% in California—property owners face an unprecedented affordability crisis. However, new construction homeowners are discovering a powerful hedge against these crushing rate increases through modern building standards and strategic coverage planning.

Quick Insights: 2025 Rate Increase Reality

- National Average Increase: 8% in 2025 (triple the inflation rate of 2.9%)

- Worst-Hit States: Louisiana (27%), California (21%), Iowa (19%)

- Annual Cost Impact: Average homeowner paying $261 more in 2025

- Four-Year Shock: Homeowners paying $1,000+ more than 2021 levels

- New Construction Shield: 20-40% lower premiums vs. comparable older homes

- Rate Projection: 95% of US ZIP codes experienced premium increases in last three years

Why Are Homeowners Insurance Rates Going Up So Dramatically?

The homeowners insurance rate increases of 2025 stem from a perfect storm of factors that are reshaping the entire insurance landscape. Understanding these drivers helps homeowners make informed decisions about their coverage strategies.

Climate Change and Severe Weather Impact

Catastrophic Loss Increases The insurance industry faces unprecedented losses from severe weather events:

- Los Angeles wildfires in January 2025: Among costliest disasters in US history

- Ohio tornadoes: 74 in 2024 vs. normal annual average of 24

- Hurricane frequency: Gulf Coast states seeing 40% increase in major storms

- Hail damage: Now accounts for 42% of all home insurance claims

Geographic Risk Expansion Weather risks are no longer confined to traditional high-risk areas:

- Flash flooding affecting historically low-risk regions

- Wildfire expansion into previously safe zones

- Severe thunderstorms intensifying across the Midwest

- Hurricane impact zones expanding northward

Construction and Material Cost Inflation

Labor Shortage Crisis The construction industry faces critical workforce shortages:

- 368,000 construction job openings in August 2024 (138,000 increase from July)

- More than double Bureau of Labor Statistics expectations

- Skilled trades shortage driving labor costs up 25-35%

- Specialized restoration work commanding premium rates

Material Cost Volatility Key building materials remain significantly more expensive:

- Lumber prices: 40% above pre-pandemic levels

- Asphalt and roofing materials: 60% increase since 2020

- Copper wiring: 50% tariff impact expected in 2025

- Steel and aluminum: 50% tariffs reintroduced as of June 2025

Reinsurance Market Pressures

Insurance for Insurance Companies Reinsurance costs—insurance that insurance companies buy—continue rising:

- Global reinsurance rates up 35% since 2022

- Natural disaster losses exceeding reinsurance capacity

- Limited capital availability for catastrophe coverage

- International market withdrawal from US coastal risks

These costs inevitably flow down to consumer premiums, amplifying rate increases across all markets.

State-by-State Rate Increase Breakdown

The Hardest Hit States

Louisiana: 27% Increase

- Average annual premium reaching $13,937 by end of 2025

- Hurricane frequency and severity driving costs

- Limited carrier competition after market exits

- Following 38% increase in 2024

California: 21% Increase

- Average rising to $2,930 annually

- Los Angeles wildfire losses accelerating increases

- Regulatory delays in rate approvals creating market instability

- Carrier withdrawals from high-risk areas

Iowa: 19% Increase

- Reaching $3,825 average annual premium

- Hail events increased 133% between 2022-2023

- Severe thunderstorm frequency rising dramatically

- Agricultural area risk assessment expanding

Regional Rate Impact Analysis

| Region | Average Increase | 2025 Premium | Key Risk Factors |

|---|---|---|---|

| Gulf Coast | 15-27% | $8,000-$15,460 | Hurricanes, storm surge |

| West Coast | 12-21% | $2,200-$4,500 | Wildfires, earthquakes |

| Midwest | 8-19% | $2,800-$4,200 | Severe storms, hail |

| Northeast | 5-12% | $2,000-$3,500 | Nor’easters, high costs |

| Southeast | 10-18% | $3,200-$6,800 | Hurricanes, flooding |

Houston, Miami, and New York Metro Impacts

Houston (Harris County)

- Premium increases: 12-15% annually

- Average cost rising to $3,200-$4,500

- Hurricane Harvey losses still affecting rates

- Flood insurance coordination increasingly critical

Miami-Dade County

- Premium increases: 18-25% annually

- Average cost: $8,500-$15,000+ for coastal properties

- Hurricane risk driving highest increases in nation

- Condo and high-rise insurance particularly affected

New York Metro

- Premium increases: 8-12% annually

- Average cost: $2,800-$4,200 (higher for luxury properties)

- Coastal storm exposure increasing

- High construction costs driving replacement value adjustments

How Much Are Homeowners Insurance Rates Really Increasing?

The sticker shock facing homeowners in 2025 reflects years of accumulated cost pressures finally being reflected in premiums.

National Rate Progression

2021-2025 Cumulative Impact:

- 2021 baseline: $2,520 average annual premium

- 2022 increase: 12% ($2,822)

- 2023 increase: 15% ($3,245)

- 2024 increase: 8% ($3,505)

- 2025 projection: 8% ($3,785)

Total four-year increase: 50% ($1,265 annually)

The Inflation vs. Insurance Cost Gap

While general inflation has moderated to 2.9%, homeowners insurance increases continue at nearly triple that rate:

Cost Driver Comparison:

- General inflation: 2.9%

- Construction costs: 8-12%

- Homeowners insurance: 24% (three-year average)

- Severe weather losses: 40% increase annually

This disconnect means insurance costs are consuming an increasingly larger share of household budgets, particularly for middle-income families.

Premium Burden by Income Level

| Household Income | Insurance % of Income 2021 | Insurance % of Income 2025 | Impact |

|---|---|---|---|

| $50,000 | 5.0% | 7.6% | Severe burden increase |

| $75,000 | 3.4% | 5.1% | Significant impact |

| $100,000 | 2.5% | 3.8% | Moderate burden |

| $150,000+ | 1.7% | 2.5% | Manageable increase |

New Construction: The Ultimate Rate Increase Hedge

While existing homeowners face relentless premium increases, new construction provides unprecedented protection against insurance inflation through multiple built-in advantages.

Modern Building Code Protection

2025 Building Standards Advantage New construction homes built to current codes offer superior protection:

Wind Resistance Standards

- Modern homes: Built to withstand 150+ mph winds

- Pre-2000 homes: Often rated for only 90-110 mph winds

- Premium reduction: 15-25% in hurricane-prone areas

- Storm damage claims: 60% fewer vs. older construction

Fire Protection Integration

- Hardwired smoke detection throughout

- Fire-resistant building materials standard

- Defensible space requirements in wildfire areas

- Insurance savings: 10-20% in fire-prone regions

Flood Mitigation Features

- Elevated construction in flood zones

- Proper drainage and grading

- Moisture-resistant materials and techniques

- Flood insurance discounts: Up to 45% with proper certification

Technology Integration Savings

New construction homes increasingly feature insurance-friendly technology:

Smart Home Monitoring Systems

- Water leak detection: 93% reduction in water damage claims

- Security systems: 60% reduction in theft losses

- Fire monitoring: Faster emergency response

- Combined discounts: 5-20% premium reduction

Energy Efficiency Benefits

- Superior insulation reducing freeze damage

- Efficient HVAC systems with monitoring

- LED lighting reducing fire risk

- Solar systems with proper safety disconnect

Material and System Advantages

Modern Electrical Systems

- GFCI protection throughout

- Arc-fault circuit interrupters

- Whole-house surge protection

- Fire risk reduction: 60% vs. homes built before 1980

Advanced Plumbing

- Modern materials resisting corrosion

- Proper installation reducing leak risk

- Water pressure regulation systems

- Claim frequency: 40% lower than older homes

HVAC Efficiency

- Zoned systems reducing equipment stress

- Regular maintenance requirements

- Indoor air quality improvements

- System failure claims: 50% reduction

Regional New Construction Advantages

Houston Market Benefits

Hurricane Preparedness

- Post-Harvey building code improvements

- Enhanced drainage requirements

- Wind load upgrades

- Storm surge planning integration

Flood Zone Optimization

- Elevation certificate benefits

- Proper flood insurance coordination

- Community Rating System participation

- Flood premium discounts: 25-45%

Miami Construction Advantages

Hurricane Code Compliance

- Miami-Dade County: Strictest building codes in nation

- Impact glass and storm shutters standard

- Enhanced roof attachment requirements

- Wind mitigation discounts: 30-50%

Coastal Protection Features

- Saltwater corrosion resistance

- Storm surge design standards

- Hurricane evacuation planning

- Flood and wind coordination

New York Metro Benefits

Winter Weather Protection

- Enhanced insulation standards

- Ice dam prevention design

- Freeze protection systems

- Winter storm damage reduction: 45%

Urban Risk Management

- Fire department access optimization

- Security system integration

- Neighboring property protection

- Liability risk reduction

Strategic Rate Increase Protection

Timing Your New Construction Purchase

Market Timing Advantages Current conditions create optimal opportunities:

- Builder incentives at 5-year highs (66% offering incentives)

- Price reductions averaging 6%

- Lower mortgage rates improving affordability

- Insurance savings providing long-term value

Pre-Purchase Rate Locking Secure insurance commitments during construction:

- Lock in current new construction rates

- Avoid potential future increases

- Plan smart home integration for maximum discounts

- Coordinate with construction timeline

Coverage Optimization Strategies

Carrier Selection for Rate Stability Working with carriers committed to new construction markets:

Preferred New Construction Carriers:

- Hartford: Strong new home discount programs and rate stability

- Travelers: Technology integration incentives

- Chubb: Premium coverage with predictable pricing for luxury homes

- Pure Insurance: High-value home specialists with rate guarantees

- Cincinnati Insurance: Regional strength with competitive new construction rates

Multi-Year Rate Protection

- Some carriers offer rate guarantees for new construction

- Bundle discounts providing additional stability

- Loyalty programs rewarding long-term relationships

- Annual review processes preventing surprise increases

Deductible Strategy for Rate Management

Higher Deductibles = Lower Premiums Many homeowners are increasing deductibles to offset premium increases:

- 2% deductible standard → 5-10% deductible options

- $400,000 home: $8,000 vs. $20,000-$40,000 deductibles

- Premium savings: 15-30% with higher deductibles

- Self-insurance for smaller claims

New Construction Deductible Advantages

- Lower claim frequency means higher deductibles less risky

- Modern systems reducing likelihood of major claims

- Warranty coverage supplementing insurance protection

- Smart monitoring reducing claim severity

Common Rate Increase Questions

Why did my homeowners insurance go up so much?

Premium increases result from multiple factors converging:

- Climate change increasing weather severity and frequency

- Construction cost inflation driving replacement costs higher

- Reinsurance market pressures affecting all carriers

- Regional risk reassessment based on recent losses

The Consumer Federation of America found homeowners insurance premiums rose twice as fast as inflation between 2021 and 2024, with the average American homeowner paying 24% higher premiums compared to three years ago.

How much will homeowners insurance cost in 2025?

National average projections show:

- 2025 National Average: $3,520 annually (8% increase from 2024)

- High-Risk States: $8,000-$15,460 annually

- Low-Risk States: $1,200-$2,500 annually

- New Construction: 20-40% below comparable older homes

Who has the cheapest homeowners insurance with rate increases?

“Cheapest” varies by individual circumstances, but carriers with strong rate stability include:

- Regional carriers with conservative pricing models

- Mutual companies with member-focused pricing

- Carriers specializing in new construction markets

- Companies with strong financial reserves

More important than finding the “cheapest” is finding sustainable value through proper coverage and rate stability.

Will homeowners insurance rates continue to go up?

Unfortunately, yes. Experts predict continued increases due to:

- Climate change effects intensifying

- Construction costs remaining elevated

- Reinsurance market capacity constraints

- Accumulated industry losses requiring recovery

However, new construction provides the best protection against these increases through superior risk profiles and modern protective features.

How much is homeowners insurance on a $400,000 house in 2025?

For a $400,000 home with standard coverage:

- Existing home (10+ years): $2,800-$4,200 annually

- New construction: $1,950-$2,800 annually

- High-risk areas: $4,000-$8,000+ annually

- With bundling discounts: 10-25% additional savings

New construction provides $850-$1,400 annual savings compared to older homes.

The Hotaling Solution for Rate Increase Protection

Our Rate Management Strategy

Proactive Market Monitoring

- Continuous carrier rate filing analysis

- Early warning of pending increases

- Alternative carrier identification

- Strategic timing of policy changes

New Construction Specialization

- Builder relationship coordination

- Construction timeline insurance planning

- Smart home integration for maximum discounts

- Seamless transition from builders risk to homeowners coverage

Portfolio Approach

- Multi-carrier market access

- Bundling optimization across product lines

- Risk management consulting

- Claims advocacy and loss control

Carrier Relationships for Rate Stability

Tier 1 Carriers (Highest Rate Stability)

- Pure Insurance: High-value homes with rate predictability

- Chubb: Premium market with conservative pricing

- Cincinnati Insurance: Mutual company with member focus

Tier 2 Carriers (Competitive Rates)

- Hartford: Strong new construction programs

- Travelers: Technology integration incentives

- Nationwide: Broad market coverage with stability

Specialty Markets

- Regional carriers for specific geographic advantages

- Excess and surplus lines for unique risks

- International carriers for global citizens

Houston, Miami, and New York Expertise

Regional Rate Management Each market requires specialized approaches:

Houston Strategy

- Hurricane season rate timing

- Flood insurance coordination

- Energy corridor risk management

- Oil and gas industry considerations

Miami Approach

- Hurricane mitigation optimization

- High-value property specialization

- International client considerations

- Condo and high-rise expertise

New York Focus

- Co-op and condo insurance coordination

- High construction cost management

- Urban risk mitigation

- Luxury property protection

Take Action: Protect Against Rate Increases

Immediate Steps for Existing Homeowners

- Annual Policy Review: Assess current coverage and identify optimization opportunities

- Carrier Comparison: Evaluate alternatives before renewal

- Home Improvements: Document upgrades that qualify for discounts

- Deductible Analysis: Consider higher deductibles for premium savings

New Construction Opportunities

- Market Timing: Take advantage of current builder incentives

- Insurance Planning: Integrate coverage strategy with construction timeline

- Technology Integration: Plan smart home features for maximum discounts

- Carrier Pre-Approval: Secure coverage commitments during construction

When to Contact Hotaling

Before Rate Increases Hit

- Annual policy renewal approaching

- Notice of rate increase received

- Major home improvements completed

- Life changes affecting coverage needs

New Construction Planning

- Construction contract review and insurance coordination

- Builder’s risk to homeowners insurance transition planning

- Smart home integration for maximum discounts

- High-value property protection strategies

Contact Hotaling Insurance Services to develop a comprehensive strategy for protecting against homeowners insurance rate increases while optimizing your coverage for the unique challenges of 2025 and beyond.

FAQ: Homeowners Insurance Rate Increases 2025

Q: How much is homeowners insurance going up in 2025? A: Nationally, homeowners insurance is increasing an average of 8% in 2025, with some states seeing increases up to 27%. The typical homeowner will pay $261 more annually, with total increases of over $1,000 since 2021.

Q: Why is my homeowners insurance so expensive now? A: Premium increases result from severe weather losses, construction cost inflation, labor shortages, and reinsurance market pressures. Climate change is making weather events more frequent and severe, while materials and labor costs have risen 25-60% since 2020.

Q: Will homeowners insurance rates go down in 2026? A: Rate decreases are unlikely given continued climate pressures, elevated construction costs, and industry loss recovery needs. However, new construction homes offer the best protection against future increases through superior risk profiles.

Q: How can I lower my homeowners insurance with rates going up? A: Strategies include increasing deductibles, bundling policies, documenting home improvements for discounts, shopping multiple carriers, and considering new construction for maximum savings potential.

Q: Is homeowners insurance more expensive than car insurance now? A: In many cases, yes. Homeowners insurance increases have far outpaced auto insurance, with some homeowners now paying more for home coverage than vehicle protection, especially in high-risk areas.

This article is for informational purposes only and does not constitute financial or insurance advice. Consult with our licensed insurance professionals to determine the best coverage strategies for your specific situation.

Author: Hotaling Insurance Services Team

Reviewed: October 16, 2025

Next Review: January 16, 2026

About Hotaling Insurance Services Hotaling Insurance Services is a nationally licensed, family-office insurance firm providing comprehensive risk management solutions for successful individuals and families. Serving clients in Houston, New York, Miami, and nationwide, we deliver specialized expertise with over 40 years of experience and partnerships with leading carriers including Hartford, Travelers, Nationwide, Pure Insurance, Chubb, Cincinnati Insurance, AIG, MetLife, Guardian, and Aetna. We uphold our core values: Excellence, All-In, Grind & Bind, Do Right, and Extreme Ownership.