Reading Time: 8 minutes

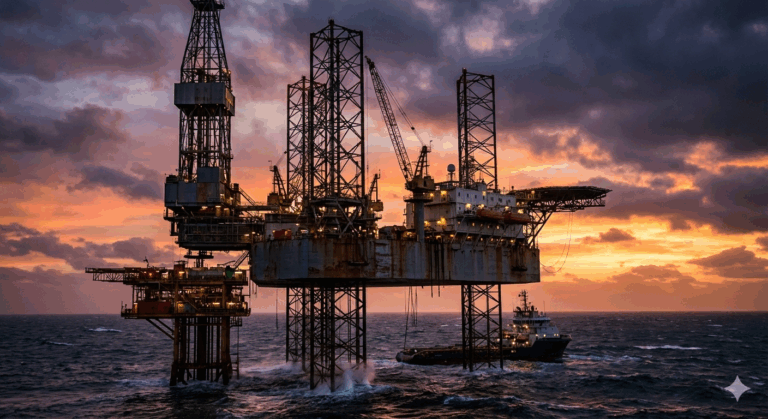

Houston Oil and Gas Insurance: How We Improve Your Energy Sector Operations

Houston’s energy sector faces unique risks from well blowouts to pipeline failures. Oil and gas insurance provides specialized coverage for drilling operations, equipment damage, environmental liability, and business interruption that standard commercial policies exclude.

Quick Insights: Oil & Gas Insurance Essentials

- Average Premium Range: $15,000-$250,000+ annually depending on operations scale

- Texas Requirements: Workers comp mandatory for drilling operations, general liability strongly recommended

- Key Coverage Gap: Standard commercial policies exclude most oil/gas operational risks

- Claim Timeline: Environmental incidents can take 18-24 months to resolve

- Houston Advantage: Local brokers understand Gulf Coast weather patterns and regulatory environment

We’ve worked with Houston energy companies since the 1980s. One client—a midstream operator with 40 miles of pipeline near the Ship Channel—called us after Hurricane Ike in 2008. His commercial property policy covered the office damage but explicitly excluded the pipeline repairs. He was looking at $2.3 million in losses with zero coverage because his previous broker had sold him a standard business policy.

That’s the problem with oil and gas operations. The risks are so specialized that generic commercial insurance leaves massive gaps. You need coverage written specifically for drilling, production, transport, and refining—and you need brokers who understand the difference between upstream and downstream exposures.

Why Standard Commercial Insurance Fails Energy Companies

Most business insurance policies contain absolute pollution exclusions and specific carve-outs for oil and gas operations. We see this constantly: a company grows from a small drilling operation into multi-well production, keeps their original insurance package, and discovers during a claim that they’re not actually covered.

The energy sector has unique operational risks that standard policies explicitly exclude:

Drilling and Production Hazards

- Well control incidents (blowouts, kicks, lost circulation)

- Underground reservoir damage from hydraulic fracturing

- Equipment failure on drilling rigs or production platforms

- Third-party damage from drilling operations on adjacent properties

Transportation and Pipeline Risks

- Pipeline ruptures causing environmental contamination

- Third-party damage to underground utilities during installation

- Product spills during truck or rail transport

- Storage tank failures and product releases

Environmental and Regulatory Exposures

- Groundwater contamination from produced water disposal

- NORM (naturally occurring radioactive material) exposure

- Air emissions violations and EPA fines

- Remediation costs for legacy contamination

Houston sits at the center of North American energy production. We’ve got upstream operations in the Eagle Ford and Permian Basin, midstream infrastructure throughout the Gulf Coast, and downstream refining capacity that processes millions of barrels daily. Each segment needs different coverage.

Essential Coverage Types for Oil & Gas Operations

1. Operators Extra Expense (OEE) / Control of Well Insurance

This is your first line of defense for drilling operations. OEE covers the costs of regaining control after a blowout, including hiring specialized well control companies, renting equipment, and redrilling if necessary.

A small independent driller working the Eagle Ford told us about a well kick at 8,000 feet. The pressure spike damaged their blowout preventer, and they needed to bring in Boots & Coots for control operations. The total bill hit $1.8 million over 17 days—their OEE policy covered every dollar.

What OEE Typically Covers:

- Well control specialists and equipment rental

- Firefighting and specialized contractors

- Seepage and pollution cleanup from the incident

- Redrilling costs if the original wellbore is lost

- Legal defense for resulting third-party claims

Policy limits usually range from $5-25 million depending on well depth and formation complexity.

2. General Liability with Energy Endorsements

Standard GL policies exclude pollution and most oil/gas operations. You need energy-specific endorsements or standalone pollution liability coverage.

One Houston-based production company we work with operates 130 wells across three counties. They pay roughly $85,000 annually for $2 million in GL coverage with pollution endorsements. When they had a tank battery spill that contaminated a rancher’s stock pond, their policy covered cleanup and legal defense—standard policies would have denied coverage entirely.

Critical Coverage Extensions:

- Sudden and accidental pollution coverage

- Underground resource damage (trespass claims from neighboring mineral owners)

- Completed operations for plugging and abandonment

- Contractual liability for operator agreements and joint ventures

3. Excess Liability / Umbrella Coverage

Energy operations create catastrophic loss potential. A single incident can generate $10-50 million in third-party claims, environmental remediation, and legal defense costs.

The Deepwater Horizon settlement exceeded $20 billion. While most Houston operators aren’t drilling in 5,000 feet of water, the principle holds: excess liability coverage is essential protection against catastrophic scenarios.

Recommended Limits:

- Small operators (1-20 wells): $5-10 million excess

- Mid-size companies (20-100 wells): $10-25 million excess

- Large independents or midstream: $25-100 million excess

4. Inland Marine / Equipment Coverage

Drilling rigs, completion equipment, and specialized tools represent massive capital investments. Inland marine policies cover this mobile equipment whether it’s on-site, in transit, or in storage.

We insured a Houston contractor who provides frac equipment across Texas. Their 12 frac spreads are worth $140 million total. When a fire destroyed one complete spread during operations in Midland, their inland marine policy paid out $11.7 million for replacement equipment.

5. Workers Compensation (Mandatory for Drilling)

Texas doesn’t require workers compensation insurance—except for specific industries including oil and gas well drilling operations. If you’re drilling wells in Texas, you must carry workers comp or qualify as a non-subscriber with substantial financial reserves.

According to OSHA data, oil and gas extraction workers face injury rates 7x higher than the private sector average. Falls, struck-by incidents, and caught-between accidents dominate the injury reports.

Current Houston Pricing (2025):

- Drilling operations: $18-32 per $100 of payroll

- Production operations: $12-22 per $100 of payroll

- Pipeline construction: $15-28 per $100 of payroll

Houston-Specific Insurance Considerations

Hurricane and Named Storm Coverage

The Gulf Coast faces hurricane exposure every season from June through November. Hurricane Harvey in 2017 caused $125 billion in damages and shut down refining capacity for weeks.

Most energy property policies include named storm deductibles—typically 2-5% of insured values, applied per occurrence. For a $50 million facility, that’s a $1-2.5 million deductible before coverage responds.

We worked with a midstream company near Texas City whose property policy had a 5% named storm deductible. After Harvey, they had $8.3 million in damage but paid the first $2.9 million out of pocket.

Mitigation Strategies:

- Buy down named storm deductibles (expensive but sometimes worth it)

- Maintain adequate cash reserves to cover deductible amounts

- Consider parametric storm insurance for immediate cash flow

- Document all pre-storm condition and post-storm damage thoroughly

Pollution Liability in Texas

Texas environmental regulations are generally less stringent than California or northeastern states, but TCEQ (Texas Commission on Environmental Quality) still imposes substantial cleanup obligations for contamination events.

Pollution liability insurance operates on a claims-made basis, meaning you need continuous coverage to address both current and past exposures. If you cancel pollution coverage, you lose protection for everything that happened during the policy period unless you purchase tail coverage.

A Houston production company we insured discovered soil contamination from operations dating back to the 1990s. Their current pollution policy covered investigation and remediation costs of $1.4 million because they’d maintained continuous coverage since 2003. If they’d let coverage lapse, they would have been self-insured for the entire claim.

What Oil and Gas Insurance Actually Costs in Houston

Pricing varies dramatically based on operations type, safety record, and coverage limits. Here’s what we’re seeing in the Houston market as of late 2025:

Small Independent Producer (5-25 wells, $3-8M annual production revenue):

- General Liability with Energy Endorsements: $25,000-45,000

- Pollution Liability: $15,000-35,000

- Property and Equipment: $12,000-28,000

- Auto Liability (10 vehicles): $18,000-32,000

- Workers Compensation (8 employees): $45,000-75,000

- Excess Liability ($5M umbrella): $8,000-15,000

- Total Annual Premium: $123,000-230,000

Mid-Size E&P Company (50-150 wells, $15-40M annual production revenue):

- General Liability: $85,000-140,000

- Pollution Liability: $65,000-120,000

- Property and Equipment: $90,000-180,000

- Auto Liability (35 vehicles): $58,000-95,000

- Workers Compensation (40 employees): $180,000-290,000

- Excess Liability ($25M umbrella): $45,000-85,000

- Total Annual Premium: $523,000-910,000

Factors That Increase Premiums:

- Poor loss history (even one major claim can double rates)

- Operations in ecologically sensitive areas

- Lack of formal safety programs and training

- Equipment age and maintenance quality

Factors That Decrease Premiums:

- Strong safety culture with documented programs

- Modern equipment with proper maintenance records

- Clean loss history over 5+ years

- Participation in industry safety initiatives (STEPS, API)

- Substantial deductibles or self-insured retentions

Common Coverage Gaps We See in Houston

After reviewing hundreds of energy company insurance programs, these gaps appear repeatedly:

1. Inadequate Contractual Liability Coverage

Master service agreements and drilling contracts often require specific insurance coverages and limits. If your policy doesn’t include contractual liability provisions, you’re personally liable for indemnification obligations.

We reviewed one operator’s contracts and found they’d agreed to defend and indemnify the surface owner for any pollution events. Their GL policy excluded contractual liability. When a small spill occurred, they paid $85,000 in legal defense costs out of pocket—coverage would have cost $3,000 annually to add.

2. Missing Cyber Coverage

SCADA systems, production monitoring, and reservoir management all run on networked computer systems. Ransomware attacks on energy infrastructure are increasing, and traditional property policies don’t cover cyber incidents.

A Houston midstream company experienced a ransomware attack that shut down pipeline operations for six days. The cyber criminals demanded $400,000 in Bitcoin. The company paid the ransom, spent another $200,000 on system restoration, and lost $1.2 million in revenue—none of it covered. The cyber policy would have cost $15,000 annually.

3. Named Storm Deductibles (Not Understanding the Exposure)

2-5% named storm deductibles can represent millions of dollars in uninsured losses. Companies regularly underestimate this exposure until hurricane season hits.

4. Insufficient Limits for Catastrophic Events

Companies often buy $2 million in GL coverage because that’s what their contract requires—then face a $15 million environmental claim that bankrupts them. Excess liability coverage is relatively inexpensive compared to the catastrophic protection it provides.

Risk Management: Reducing Your Insurance Costs

Insurance is expensive in the energy sector, but risk management investments pay dividends through reduced premiums and improved operational safety.

Implement Formal Safety Programs

Insurers want to see documented safety programs including written policies, regular training, incident investigation protocols, and equipment inspection schedules. Companies with robust safety programs qualify for premium discounts of 10-25%.

Invest in Loss Control

Specific investments that reduce claims and lower premiums include pipeline integrity monitoring systems, automated leak detection equipment, blowout preventer testing, spill response equipment, and vehicle telematics for fleet safety.

Increase Deductibles Strategically

Higher deductibles reduce premium costs significantly. A $25,000 deductible vs. $100,000 deductible might save 20-30% in annual premium—worthwhile if you have the financial strength to absorb smaller losses.

Frequently Asked Questions

Do I need insurance if I’m only a working interest owner, not the operator?

Yes. While the operator maintains primary insurance, working interest owners face exposure for their proportionate share of liabilities. We recommend non-operator coverage including pollution liability for your working interest percentage, excess liability above the operator’s limits, and contractual liability for indemnification obligations in the JOA.

How does insurance work for acquisitions of producing properties?

Property acquisitions create insurance complexity. The seller’s coverage typically terminates at closing, so you need reps and warranties insurance to cover unknown environmental conditions, immediate pollution liability coverage for newly acquired assets, and updated property coverage. We always recommend starting the insurance process 60-90 days before closing.

Can I self-insure instead of buying coverage?

Texas allows self-insurance for certain coverages if you meet financial requirements. However, most contracts and regulatory obligations require proof of insurance—self-insurance rarely satisfies these requirements. Additionally, one catastrophic event can wipe out years of “savings” from skipping insurance premiums.

How long do I need to keep pollution liability coverage after I stop operating?

Indefinitely, or at least until your potential exposures from past operations are resolved. Pollution claims can emerge decades after operations cease—contamination discovered in 2025 from 1990s operations is common. When you stop operating, buy “tail coverage” that covers future claims arising from past operations.

The Bottom Line on Houston Oil & Gas Insurance

Energy operations create specialized risks that standard commercial insurance doesn’t address. From well control incidents to environmental contamination to catastrophic equipment failures, the exposures are substantial and the potential losses can be company-ending.

The cost of proper insurance—$125,000 to $900,000 annually depending on your scale—seems expensive until you face an uninsured $5 million environmental claim or a $15 million third-party lawsuit.

We’ve worked in this industry since the 1980s. We’ve seen operators survive catastrophic losses because they had proper coverage, and we’ve watched companies fold because they tried to save money on insurance. The difference often comes down to working with someone who actually understands energy insurance and structures coverage properly from the beginning.

Houston’s energy sector isn’t going anywhere. Oil and gas will remain critical to the global economy for decades, and Houston will remain at the center of it. Make sure your insurance program protects your operations, your assets, and your business.

This article is for informational purposes only and does not constitute financial or insurance advice. Consult with our licensed insurance professional to assess your particular situation and coverage needs.

Author: Hotaling Insurance Team

Last Updated: December 12, 2025

Reviewed By: Hotaling Commercial Insurance Team

Ready to discuss your energy insurance needs? Contact Hotaling Insurance Services at our Houston office or request a quote online.