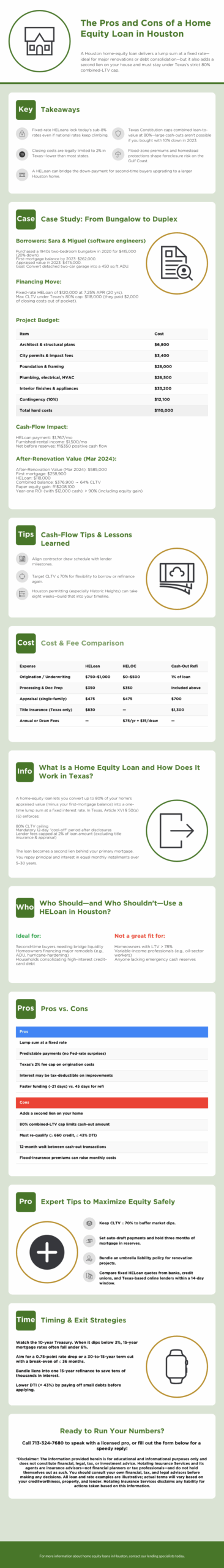

The Pros and Cons of a Home Equity Loan in Houston

Key Takeaways: Should You Tap Your Houston Home Equity?

- Fixed-rate HELoans lock today’s sub-8 % rates even if national rates keep climbing.

- Texas Constitution caps your combined loan-to-value at 80 %—large cash-outs aren’t possible if you bought with 10 % down in 2023.

- Closing costs are legally limited to 2 % in Texas—lower than most states.

- Flood-zone premiums and homestead protections shape foreclosure risk on the Gulf Coast.

- A HELoan can bridge the down-payment for second-time buyers upgrading to a larger Houston home.

What Is a Home Equity Loan and How Does It Work in Texas?

A home-equity loan (HEL) lets you convert up to 80 % of your home’s market value, minus your first-mortgage balance, into a one-time lump sum at a fixed interest rate. In Texas, all such “cash-out” loans are governed by Article XVI § 50(a)(6). The statute enforces:

- A combined loan-to-value (CLTV) ceiling of 80 %.

- Mandatory 12-day “cool-off” period after receiving disclosures.

- Total lender fees ≤ 2 % of the loan amount (excluding third-party title & appraisal).

The lender files a second lien behind your primary mortgage. You repay principal and interest in equal monthly installments over 5 – 30 years.

Who Should – and Who Shouldn’t – Use a HELoan in Houston?

Ideal borrowers: second-time buyers needing bridge liquidity, owners financing value-boosting remodels (e.g., ADU or hurricane-hardening upgrades) and households consolidating credit-card balances above 18 % APR.

Sketchy fits: homeowners with LTV > 78 %, oil-sector workers facing variable income, and anyone lacking emergency savings—because missing payments risks foreclosure despite Texas’s homestead protections.

Why Choose a HELoan Over a HELOC or Cash-Out Refi?

- Fixed-rate predictability: Houston HELOCs float at prime + 1 – 2 %, so a Fed hike can spike payments.

- No restart of 30-year clock: HELoans don’t reset your primary mortgage amortization like a refi does.

- Texas fee cap: HELoan origination can be cheaper than HELOCs that charge annual fees and draw fees.

When Do Houston Lenders Approve HELoans?

Expect this timeline:

- Day 0: Apply → receive § 50(a)(6) disclosures.

- Day 1-3: Provide W-2s, pay stubs, homeowner’s-insurance binder.

- Day 4-10: Home appraisal & title search.

- Day 12: Earliest legal date to close.

- Day 15: Closing + three-day right of rescission.

- Day 18-21: Funds wire to your checking account.

How Much Does a $100k Home Equity Loan Cost Per Month?

| Loan Size | Term | Rate* | Monthly P&I | Total Interest |

|---|---|---|---|---|

| $100,000 | 10 yrs | 7.75 % | $1,188 | $42,580 |

| $100,000 | 15 yrs | 7.85 % | $949 | $70,820 |

| $100,000 | 20 yrs | 7.90 % | $817 | $96,155 |

| $100,000 | 30 yrs | 8.05 % | $739 | $166,070 |

*Illustrative Houston averages, June 30 2025. Actual APR varies by credit score and lender.

What Are the Main Pros of a Houston Home Equity Loan?

- Stable payments — lock in a 15- or 20-year rate before the next Fed move.

- Low out-of-pocket fees — 2 % origination cap protects borrowers.

- Tax advantages — interest remains deductible when proceeds “substantially improve” your homestead (consult your CPA).

- Fast funding — three-week pipelines beat 45-day refis.

- Bridge-loan alternative — frees equity for the next down-payment without a contingent-sale contract.

What Are the Cons and Hidden Catches?

- Second-lien risk: foreclosure is rare but real if you default.

- 80 % CLTV ceiling: limits cash-out amount for recent buyers.

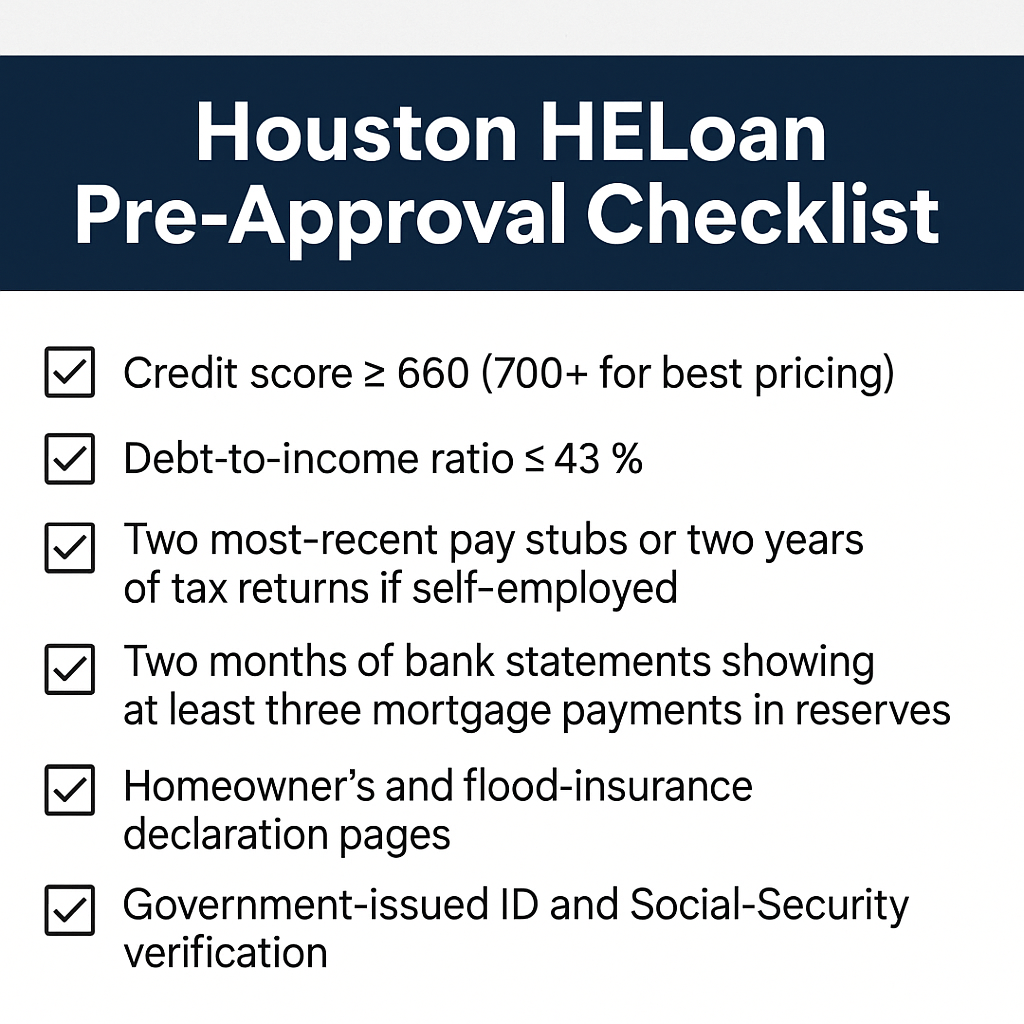

- Must re-qualify: expect ≥ 660 credit & 43 % DTI.

- No “re-cash-out” for 12 months: Texas law forbids back-to-back equity extractions.

- Flood insurance costs: FEMA maps + private-market premiums may rise, raising the total housing payment.

Cost & Coverage Breakdown

| Expense | Typical Houston Cost | Included in 2 % Cap? |

|---|---|---|

| Origination / Underwriting | $750 – $1,000 | ✔ |

| Processing Fee | $350 | ✔ |

| Title Insurance (Texas promulgated) | $830 | ✖ |

| Appraisal (single-family) | $475 | ✖ |

| Flood-zone Cert. | $22 | ✔ |

| Recording & Doc Stamps | $95 | ✔ |

Expert Tips to Maximize Equity Without Losing Sleep

-

- Keep CLTV at ≤ 70 %; you’re unlikely to dip underwater in a moderate market correction.

- Set payments on auto-draft and keep three mortgage payments in cash reserves.

- Bundle an umbrella liability policy when renovating—contractor accidents happen.

- Compare fixed HELoan quotes from banks, credit-unions and Texas-based online lenders within the same 14-day credit window.

Exit Strategies & Timing Your Refinance

-

Watch the 10-year Treasury. When it slips below 3 %, 15-year mortgage rates in Texas often drop under 6 %.

-

Aim for a 0.75-point rate drop or a 30- to 15-year term cut with a break-even of 36 months or less.

-

Bundle liens. Rolling the first mortgage and HELoan into one 15-year refinance can shave $40 k-plus in interest on a $375 k balance.

-

Keep DTI under 43 %. Paying off small auto loans or cards before applying boosts approval odds and pricing.

Texas Cash-Out Rules at a Glance (Article XVI § 50(a)(6))

-

Combined LTV cap: 80 % of a home’s appraised value

-

Fee limit: Lender fees may not exceed 2 % of the loan amount (title insurance and appraisal are excluded)

-

Mandatory waiting period: 12 calendar days between disclosure and closing

-

One equity loan per year: You can’t do two cash-outs within the same 12-month window

-

Permanent cash-out status: Any future refinance of this loan is still treated as a cash-out in Texas

Case Study – From Bungalow to Duplex in the Heights

Borrowers: “Sara & Miguel,” two software engineers who bought a 1940s two-bedroom bungalow in 2020 for $415,000 (20 % down). By early 2023 their first-mortgage balance had amortized to $262,000; a fresh appraisal valued the property at $475,000, giving them ≈ 45 % equity.

Goal: Convert the detached two-car garage into a 450-sq-ft accessory dwelling unit (ADU) to rent to traveling nurses and energy-sector contractors.

Financing move: Fixed-rate HELoan of $120,000 at 7.25 % APR (20 yrs). Texas’s 80 % CLTV limit kept the max around $118 k, so they paid $2 k of closing costs out of pocket to stay compliant.

Budget breakdown:

- Architect & structural plans – $6,800

- City permits & impact fees – $3,400

- Foundation & framing – $28,000

- Plumbing, electrical, HVAC – $26,500

- Interior finishes & appliances – $33,200

- 10 % contingency – $12,100

- Total hard cost – $110,000

The remaining $10,000 paid for a six-month builder’s-risk policy, furnishings for mid-term renters, and first-year flood insurance.

Cash-flow impact:

- HELoan payment – $1,767 / mo

- Furnished-rental income – $1,500 / mo

- Net before reserves – ≈ $350 positive cash flow (about 85 % of the payment covered)

After-renovation value (Mar 2024): New appraisal at $585,000.

- First mortgage – $258,900

- HELoan – $118,000

- Combined balance – $376,900 → 64 % CLTV

Return on investment: Paper equity gain ≈ $208,100; annual net cash flow ≈ $4,200. On the $12 k cash they injected, year-one ROI > 90 % when equity gain is counted.

Lessons learned:

- Align the contractor’s draw schedule with the lender; second-lien banks release funds only at set milestones.

- Houston permitting & Historic Heights approvals can take eight weeks—build that into your timeline.

- Target CLTV < 70 % for flexibility to borrow again or refinance both liens into one loan when rates drop.

- Mid-term (30-90 day) furnished rentals in the Medical Center corridor command higher rents and lower vacancy than standard one-year leases.

Sara and Miguel plan to refinance both liens into a single 15-year mortgage if rates fall below 6 %, trimming their lifetime interest cost by an estimated $40,000 while locking in the ADU’s cash-flow advantage.

Download the Houston HELoan Pre-Approval Checklist

Cost & Fee Comparison (Typical Houston Numbers)

| Expense | HELoan | HELOC | Cash-Out Refi |

|---|---|---|---|

| Origination / Underwriting | $750–$1,000 | $0–$500 | 1 % of loan |

| Processing & Doc Prep | $350 | $350 | Included above |

| Appraisal (single-family) | $475 | $475 | $700 |

| Title Insurance | $830 | — | $1,300 |

| Annual or Draw Fees | — | $75 per year + $15 per draw | — |

What If Houston Prices Dip? — Negative-Equity Safety Nets

-

Recast instead of refinance. For $300-$500 most lenders will lower your payment after a lump-sum principal curtailment.

-

Annual partial pay-downs. Apply bonuses or tax refunds directly to the second lien—no pre-pay penalty.

-

Refi to a 15-year loan when rates fall. You’ll rebuild equity roughly twice as fast.

-

Maintain a six-month cash cushion. Second-lien foreclosures move faster than first-mortgage defaults.

Houston Home Equity Loan FAQs

What’s the downside of a home equity loan?

You add another mortgage payment, and a market dip could erase equity. Texas law keeps LTV conservative, but missed payments still risk foreclosure.

What’s the catch?

Strict underwriting (DTI ≤ 43 %, credit ≥ 660) and a 12-day wait period. Title and appraisal fees fall outside the 2 % cap.

Is pulling equity a good idea?

Yes—when the proceeds beat the cost of funds. Renovations, high-interest debt payoff and bridge down-payments usually pencil out; vacations don’t.

What’s the payment on $100k?

See repayment table above—ranges $739-$1,188 depending on term.

Is a HELoan smart for debt consolidation?

Only if you close the cards and stick to a budget. Otherwise you risk turning unsecured debt into foreclosure-worthy secured debt.

Is home equity really “worth it”?

Idle equity earns 0 %. Managed wisely, it can fund assets that out-earn the loan rate.

Conclusion – Is a HELoan Worth It for You?

For many Houston second-time buyers, a fixed-rate home-equity loan delivers fast, predictable cash that a HELOC or cash-out refi can’t match—provided you keep CLTV conservative and have rock-solid cash flow. Compare offers, factor in Texas’s unique 2 % fee cap and 80 % LTV ceiling, and use equity as a lever—not a crutch.

Coverage to Protect Your Investment

1. Flood Insurance

Houston’s coastal location and FEMA-mapped flood zones make flood coverage essential for any homeowner tapping into their equity. A standalone flood policy protects against losses from tidal surges and heavy rain—perils not covered under a standard homeowners policy hotalinginsurance.com.

2. Homeowners (Hazard) Insurance

Lenders require hazard (homeowners) insurance to safeguard the primary dwelling and personal property against fire, wind, theft, etc. Bundling this with a HELoan ensures all loan-closing requirements are met and keeps borrowers compliant with Texas law hotalinginsurance.com.

3. Personal Umbrella Liability Insurance

When borrowers use HELoan proceeds for major renovations, contractor accidents or on-site injuries can expose them to liability claims. A personal umbrella policy provides excess liability coverage over their homeowners (and auto) limits, offering six- or seven-figure protection at relatively low cost hotalinginsurance.com.

4. Builder’s Risk Insurance

For clients converting equity into construction funds—like Sara & Miguel’s ADU project—a builder’s risk policy shields materials, equipment, and in-progress work from fire, theft, flood-related damage, and more. Premiums typically run 1–3 % of total project value hotalinginsurance.com.

Ready to run your numbers? Call 713-324-7680 to speak with a licensed pro. You can also fill out the form below for a speedy reply!