Builders Risk Insurance: Construction Coverage vs Homeowners Insurance

Last Updated: October 16, 2025

With construction timelines averaging about 19.6 months give or take, and material costs rising 8% annually, proper insurance coverage during the building phase is more important than ever. Here’s our complete guide to builders risk insurance requirements and seamless transitions to permanent homeowners coverage for those preparing to build a property/home.

Quick Insights: Builders Risk Insurance Essentials

- Coverage Cost: 1-5% of construction value ($1,000-$5,000 per $100,000 of construction spending)

- Average Timeline: 12-18 months maximum coverage period

- Critical Gap: Standard homeowners insurance doesn’t cover homes under construction

- Material Theft: Average loss of $15,000-$50,000 per incident without proper coverage

- Transition Timing: Zero-gap coverage essential between builders risk and permanent homeowners insurance

Do You Need Homeowners Insurance During Construction?

The answer is nuanced: you don’t need traditional homeowners insurance during construction, but you absolutely need specialized builders risk insurance. Standard homeowners policies specifically exclude coverage for homes under construction, leaving a dangerous gap that could cost hundreds of thousands in unprotected losses.

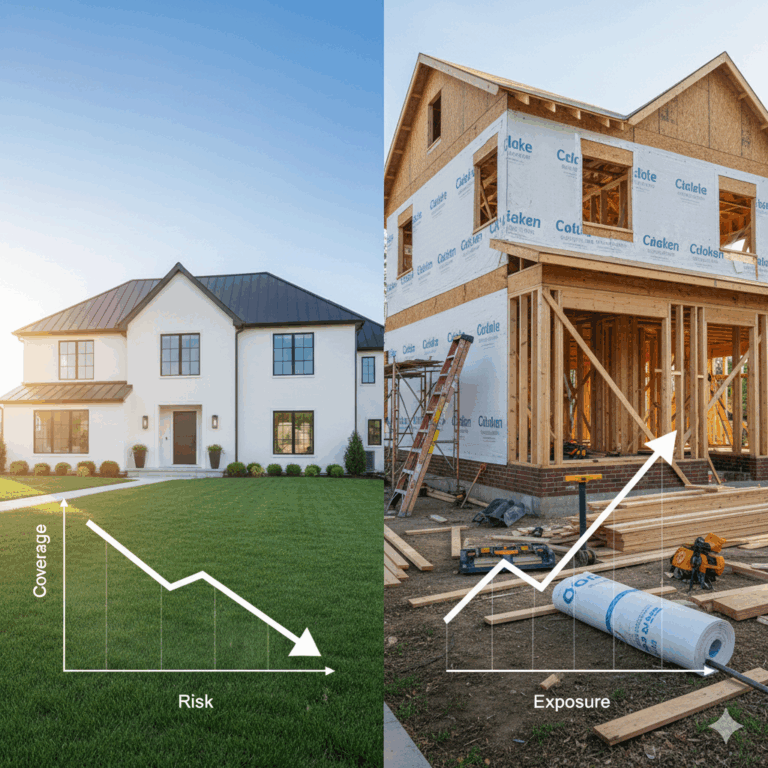

The Coverage Gap Problem

When homeowners ask “do I need homeowners insurance during construction,” they’re identifying a vulnerability period. Here’s why standard coverage doesn’t work:

Standard Homeowners Insurance Exclusions:

- Homes under construction or renovation

- Vacant or unoccupied properties during building

- Materials are stored on-site before installation

- Theft of construction equipment and supplies

- Weather damage to unfinished structures

This gap can be catastrophic. A single severe weather event or theft incident can result in losses exceeding $100,000, potentially derailing your entire project.

Construction Timeline Insurance Strategy

| Construction Phase | Required Coverage | Key Protections |

|---|---|---|

| Pre-Construction | Land/Lot insurance | Liability for vacant land |

| Active Construction | Builders risk insurance | Materials, work in progress, theft |

| Final Inspections | Transition planning | Coverage gap prevention |

| Move-In Ready | Homeowners insurance | Full property protection |

What Is Builders Risk Insurance?

Builders risk insurance (also called “course of construction insurance“) is specialized coverage designed specifically for properties under construction. Unlike homeowners insurance, it addresses the unique risks of active building sites.

Core Coverage Components

Physical Structure Protection

- Foundation and framing work in progress

- Installed materials and fixtures

- Temporary structures and construction trailers

- Architectural plans and specifications

Materials Coverage

- On-site building materials awaiting installation

- Off-site materials stored at approved locations

- Tools and equipment (with limitations)

- Landscaping materials and fixtures

Weather and Natural Disaster Protection

- Wind and hail damage to unfinished structures

- Fire damage during construction

- Lightning strikes affecting work in progress

- Flood damage (with separate flood coverage)

What Builders Risk Insurance Doesn’t Cover

Understanding exclusions is crucial for comprehensive protection:

Excluded Perils:

- Faulty workmanship or design errors

- Normal wear and tear during construction

- Mechanical breakdown of equipment

- Employee theft by contractor’s workers

- Delays in construction timeline

- Cost overruns due to material price increases

Professional Liability Exclusions:

- Architect or engineer design flaws

- Building code violations

- Permit and zoning issues

- Environmental contamination

Builders Risk vs Homeowners Insurance: Key Differences

Understanding these distinctions helps ensure proper coverage throughout your project:

Coverage Scope Comparison

| Aspect | Builders Risk Insurance | Homeowners Insurance |

|---|---|---|

| Duration | Temporary (12-18 months max) | Ongoing annual renewals |

| Property Status | Under construction only | Completed, occupied homes |

| Personal Property | Limited/excluded | Comprehensive coverage |

| Liability | Limited or excluded | Full premises liability |

| Living Expenses | Not applicable | Additional living expenses |

| Cost | 1-5% of construction value | 0.3-1.5% of home value annually |

Who Purchases Each Policy

Builders Risk Insurance Purchaser:

- Property owner (if acting as general contractor)

- General contractor (if specified in contract)

- Lender requirement (for construction loans)

Homeowners Insurance Purchaser:

- Property owner at closing

- Required by mortgage lender

- Effective at certificate of occupancy

How Much Does Builders Risk Insurance Cost?

Builders risk insurance typically costs between 1% and 5% of the total construction project value, making it a significant but necessary expense for comprehensive protection.

Cost Breakdown by Project Value

| Construction Value | Annual Premium Range | Monthly Cost | Coverage Highlights |

|---|---|---|---|

| $100,000 | $1,000 – $5,000 | $83 – $417 | Basic theft and weather protection |

| $300,000 | $3,000 – $15,000 | $250 – $1,250 | Enhanced materials coverage |

| $500,000 | $5,000 – $25,000 | $417 – $2,083 | Comprehensive site protection |

| $1,000,000+ | $10,000 – $50,000+ | $833 – $4,167+ | Premium coverage with extensions |

Factors Affecting Builders Risk Premiums

Geographic Risk Factors:

- Houston: Hurricane and flood exposure increase premiums 15-25%

- Miami: Hurricane risk and high theft rates drive costs up 20-30%

- New York Metro: High construction costs and liability exposure add 10-20%

Construction-Specific Variables:

- Building materials (fire-resistant materials reduce costs)

- Construction timeline (longer projects cost more)

- Site security measures (reduces theft-related premiums)

- Contractor experience and insurance record

Optional Coverage Enhancements:

- Soft costs coverage (architectural fees, permit costs): +0.5-1% of premium

- Delayed completion coverage: +1-2% of premium

- Ordinance and law coverage: +0.5-1.5% of premium

Critical Coverage Transitions: Avoiding Gaps

The most dangerous period for construction projects occurs during coverage transitions. Poor coordination can leave you completely unprotected during vulnerable periods.

Pre-Construction Phase

Before breaking ground, ensure proper liability coverage for your building site:

Vacant Land Liability

- Protects against injuries on undeveloped property

- Covers environmental liability during site preparation

- Addresses contractor access and safety requirements

Active Construction Coverage

Builders Risk Activation Timeline:

- 30 days before construction: Secure builders risk quotes

- Construction start date: Activate coverage immediately

- Monthly reviews: Monitor progress and adjust limits

- 60 days before completion: Begin homeowners insurance planning

The Critical Transition Period

The most vulnerable period occurs during the final 30 days of construction when:

- Builders risk coverage may be expiring

- Home isn’t quite ready for standard homeowners insurance

- Valuable fixtures and appliances are being installed

- Site security may be reduced as work winds down

Our Transition Protocol:

- 90-day advance planning: Begin homeowners insurance underwriting

- Final inspection coordination: Align coverage with certificate of occupancy

- Seamless handoff: Ensure zero-gap coverage transition

- Claims coordination: Transfer any pending builders risk claims

Regional Considerations for Houston, Miami, and New York

Each of our primary markets presents unique builders risk challenges requiring specialized expertise:

Houston Construction Insurance

Hurricane Season Planning (June-November)

- Enhanced wind and hail coverage essential

- Flood insurance coordination with builders risk

- Storm surge protection for coastal projects

- Rapid claim response for weather-related damage

Regulatory Requirements:

- Harris County building codes compliance

- Flood zone construction standards

- Wind load requirements for hurricane resistance

Miami Construction Coverage

Hurricane and Weather Protection

- Miami-Dade County building codes (strictest in nation)

- Hurricane season construction timeline planning

- Storm shutter and impact glass requirements

- Saltwater corrosion protection considerations

High-Value Construction Factors:

- Luxury materials requiring specialized coverage

- Theft protection in high-crime construction zones

- International contractor coordination and insurance verification

New York Metro Builders Risk

Urban Construction Challenges

- Neighboring property damage liability

- Construction traffic and access issues

- High-value materials in urban environments

- Strict building codes and inspection requirements

Cost Factors:

- Higher labor costs affecting replacement values

- Extended construction timelines due to regulations

- Premium materials requiring enhanced coverage

- Coordination with co-op and condo building requirements

Smart Technology and Builders Risk

Modern construction increasingly incorporates technology that requires specialized coverage considerations:

Covered Technology During Construction

- Security systems and cameras

- Temporary heating and cooling equipment

- Construction management software and hardware

- Smart building infrastructure being installed

Technology Protection Strategies

- Document all installed technology for coverage verification

- Coordinate with smart home system installers for proper coverage

- Plan technology coverage transition to homeowners policy

- Ensure adequate limits for high-value integrated systems

Common Builders Risk Insurance Questions

How long does builders risk insurance last?

Typically 12 months maximum, with options to extend for complex projects. Coverage must end when the certificate of occupancy is issued or the home becomes occupied.

Who needs to buy builders risk insurance?

Usually the property owner, but contracts may specify the general contractor purchases coverage. Review your construction contract carefully to understand responsibility.

Does builders risk insurance cover theft of materials?

Yes, theft of building materials and equipment is typically covered, subject to policy limits and security requirements. This is often the most common claim type.

Will builders risk insurance cover construction delays?

Standard builders risk doesn’t cover delays, but “soft costs” or “delay in completion” endorsements can be purchased separately to cover some delay-related expenses.

How much is homeowners insurance after builders risk expires?

New construction typically qualifies for 20-40% discounts on homeowners insurance, making the transition financially beneficial compared to insuring older homes.

The Hotaling Advantage for Construction Projects

With specialized expertise in Houston, Miami, and New York construction markets, Hotaling Insurance Services provides comprehensive support throughout your building project:

Our Construction Insurance Process

Phase 1: Pre-Construction Planning

- Review construction contracts for insurance requirements

- Coordinate with lenders for builders risk specifications

- Establish coverage limits based on detailed project costs

- Plan transition strategy to permanent homeowners coverage

Phase 2: Active Construction Management

- Monthly progress reviews and coverage adjustments

- Coordinate with contractors for compliance verification

- Claims support for weather or theft-related losses

- Regular communication with project stakeholders

Phase 3: Seamless Transition Execution

- Begin homeowners insurance underwriting 60 days before completion

- Coordinate final inspections and certificate of occupancy

- Execute zero-gap coverage transition

- Optimize new homeowners policy with available discounts

Why Choose Hotaling for Construction Insurance

Specialized Market Knowledge

- Deep understanding of Houston, Miami, and NYC construction requirements

- Relationships with contractors and builders in all three markets

- Experience with luxury and high-value construction projects

Carrier Relationships

- State Farm: Leading builders risk provider with competitive rates

- Chubb: Premium coverage for luxury construction projects

- Travelers: Excellent construction-to-homeowners transition programs

- Hartford: Strong regional presence and claim service

- Nationwide: Competitive rates for standard construction projects

Comprehensive Risk Management

- Proactive site visits and risk assessments

- Coordination with construction lenders and legal teams

- Claims advocacy throughout the construction process

- Long-term relationship building for ongoing insurance needs

Take Action: Protect Your Construction Investment

Construction projects represent significant financial investments requiring specialized insurance protection. Don’t leave your project vulnerable to preventable losses.

Immediate Next Steps

- Construction Contract Review: Verify insurance requirements and responsibilities

- Builders Risk Quote Process: Compare coverage options and costs

- Timeline Coordination: Align insurance with construction milestones

- Transition Planning: Establish homeowners insurance strategy

When to Contact Us

Before Construction Begins:

- Review contracts and insurance requirements

- Establish builders risk coverage

- Coordinate with construction lenders

During Construction:

- Monthly coverage reviews and adjustments

- Weather event preparation and response

- Theft or damage claim support

Approaching Completion:

- Homeowners insurance planning and underwriting

- Coverage transition coordination

- Final inspection and certificate of occupancy timing

Contact Hotaling Insurance Services to discuss your construction insurance needs and ensure comprehensive protection throughout your building project.

FAQ: Builders Risk and Construction Insurance

Q: Does homeowners insurance cover a house under construction? A: No, standard homeowners insurance specifically excludes coverage for homes under construction. You need specialized builders risk insurance during the construction phase.

Q: What happens if I don’t have builders risk insurance? A: You’re personally liable for all losses during construction, including theft (averaging $15,000-$50,000), weather damage, and vandalism. This could total hundreds of thousands in losses.

Q: Can I get builders risk insurance if I’m acting as my own general contractor? A: Yes, owner-builders can purchase builders risk insurance. However, you’ll need to demonstrate adequate experience and may face higher premiums or additional requirements.

Q: Does builders risk insurance cover faulty workmanship? A: No, builders risk doesn’t cover faulty workmanship, design errors, or construction defects. These issues are covered by contractor warranties and professional liability insurance.

Q: How do I transition from builders risk to homeowners insurance? A: Begin the homeowners insurance process 60-90 days before completion. The new policy should become effective the same day builders risk expires, ensuring no coverage gaps.

This article is for informational purposes only and does not constitute financial or insurance advice. Consult with our licensed insurance professionals to determine the best coverage for your specific construction project.

Author: Hotaling Insurance Services Team

Reviewed: October 16, 2025

Next Review: January 16, 2026

About Hotaling Insurance Services Hotaling Insurance Services is a nationally licensed, family-office insurance firm providing comprehensive risk management solutions for successful individuals and families. Serving clients in Houston, New York, Miami, and nationwide, we deliver specialized expertise with over 40 years of experience and partnerships with leading carriers including Hartford, Travelers, Nationwide, Pure Insurance, Chubb, Cincinnati Insurance, AIG, MetLife, Guardian, and Aetna. We uphold our core values: Excellence, All-In, Grind & Bind, Do Right, and Extreme Ownership.