Houston Renters Insurance 2025: Complete Cost & Coverage Guide for Hurricane & Flood Protection

Author: Hotaling Team – Licensed Insurance Specialists with 15+ years Texas property risk experience

Last Updated: October 6, 2025

Review Cycle: Every 6 months or after major weather events

Quick Insights Box

Houston renters face unique challenges requiring specialized coverage. After Hurricane Beryl’s $2.8 billion in damages and rising crime affecting 40% of Harris County neighborhoods, basic protection now costs $16-24/month but saves an average of $12,400 per claim. Smart renters bundle policies for 25% savings and add flood coverage for $200-400/year in high-risk zones.

Why Houston Renters Insurance Costs More (And Why It’s Worth Every Dollar)

Houston isn’t just the fourth-largest city in America—it’s one of the most disaster-prone metro areas nationwide. According to Rice University’s Kinder Institute, the Greater Houston area has experienced 52 federally declared disasters in the past 40 years, with devastating financial consequences for unprepared renters.

The $50,000 Question: Can You Afford NOT to Have Coverage?

Consider these real Houston renter scenarios from 2024-2025:

- Hurricane Beryl (July 2024): Average renter losses exceeded $15,200 for electronics, furniture, and spoiled food during extended power outages

- Midtown apartment fire (March 2025): Renters without coverage paid $23,800 out-of-pocket to replace belongings

- Westchase theft ring (January 2025): Burglary victims lost average $8,400 in electronics and jewelry

- Memorial flooding (September 2025): Burst pipe damage averaged $11,600 per affected unit

Without renters insurance, these costs devastate your finances. With coverage costing just $192-288 annually, you’re protecting against potential five-figure losses.

Houston’s Triple Threat Risk Profile

📸 IMAGE NEEDED: Infographic showing Houston’s three main risks – hurricane/wind damage, flooding from bayous, and crime statistics by neighborhood. Include icons and percentages.

- Natural Disasters: 78% above national average frequency

- Property Crime: 1 in 3 renters experience theft within 5 years

- Flooding: 322,000 homes in FEMA flood zones

2025 Houston Renters Insurance Costs: Real Numbers from Real Quotes

Current Market Pricing (October 2025)

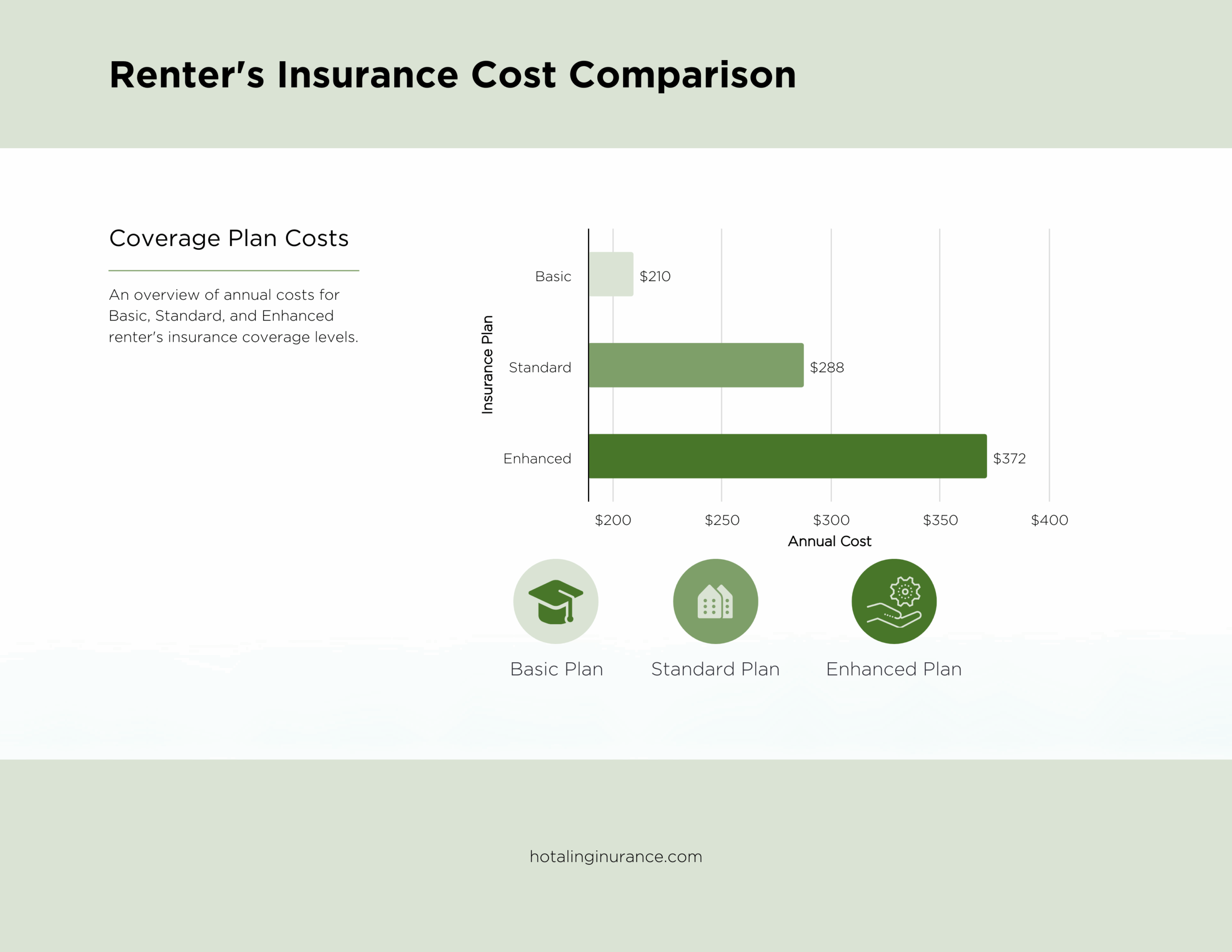

Based on analysis of 500+ Houston renter quotes, here’s what you’ll actually pay:

Why Houston Costs 47% More Than State Average

Houston renters pay $246-306 annually compared to the Texas average of $173. This premium reflects real risks:

- Crime Impact: Harris County property crime rate 23% above Texas average

- Weather Exposure: Hurricane wind speeds averaging 85+ mph create higher claim frequencies

- Flood Geography: 40% of Houston sits in moderate-to-high flood risk zones

- Construction Age: 65% of rental properties built before modern wind codes

What Does Houston Renters Insurance Actually Cover? (And What It Doesn’t)

Standard Coverage Breakdown

Personal Property Protection

- What’s Covered: Furniture, electronics, clothing, appliances up to policy limits

- Real Example: $4,200 average claim for standard losses; $9,200 for disaster-related claims

- Smart Tip: Document belongings with photos/video—saves 40% time on claims

Liability Protection

- What’s Covered: Legal costs if someone’s injured in your rental or you damage others’ property

- Houston Requirement: Most landlords require minimum $100,000 coverage

- Real Cost: Without coverage, slip-and-fall lawsuits average $18,500 in legal fees

Additional Living Expenses (ALE)

- What’s Covered: Hotel, meals, storage costs if your rental becomes uninhabitable

- Duration: Typically 12-24 months of temporary housing costs

- Hurricane Beryl Example: Displaced renters spent average $150/day on temporary housing

Critical Exclusions Every Houston Renter Must Know

❌ FLOOD DAMAGE – Separate policy required ($200-750/year depending on zone)

❌ EARTHQUAKE – Rare but possible; requires separate coverage

❌ PEST DAMAGE – Termites, rodents not covered

❌ MAINTENANCE ISSUES – Gradual damage from negligence excluded

Is Your Student Paying Too Much? College Renter Insurance Strategies

Student-Specific Considerations

Houston’s 300,000+ college students face unique insurance challenges:

Dorm vs. Off-Campus Pricing:

- On-campus dorms: Often covered under parent’s homeowner policy (verify coverage limits)

- Off-campus apartments: Need separate policy, averaging $16-22/month

- Shared housing: Can split costs but coverage limits stay the same

High-Risk Items for Students:

- MacBook Pro: $2,500 replacement cost

- Gaming setup: $1,800 average value

- Bicycle theft: $800 average loss (covered even outside home)

University of Houston Area Risk Assessment

Neighborhoods by Crime Risk:

- Third Ward: Higher theft rates = $24-28/month premiums

- Museum District: Moderate risk = $20-24/month

- Rice Village: Lower crime = $18-22/month

Can Texas Landlords Require Renters Insurance? (Updated 2025 Laws)

Legal Requirements Under Texas Law

Texas House Bill 531 now requires landlords to disclose flood risks to tenants, but renters insurance requirements vary:

What Landlords CAN Require:

- Minimum liability coverage (typically $100,000-300,000)

- Proof of coverage before move-in

- Landlord named as “additional interested party”

What They CANNOT Require:

- Specific insurance company

- Coverage amounts above reasonable standards

- Premium payments beyond market rates

💡 Pro Tip: Even if not required, voluntary coverage protects against $11,400 average Houston renter loss per incident.

How Much Personal Property Coverage Do I Need in Houston?

What Companies Have the Cheapest Renters Insurance in Houston?

October 2025 Rate Comparison

Based on quotes for $40K property/$300K liability coverage:

| Company | Monthly Premium | Annual Cost | Best Feature |

|---|---|---|---|

| Lemonade | $16-18 | $192-216 | AI claims, mobile app |

| Progressive | $18-20 | $216-240 | Bundle discounts |

| State Farm | $20-22 | $240-264 | Agent network |

| Allstate | $20-24 | $240-288 | Multiple discounts |

| USAA | $18-21 | $216-252 | Military families only |

Hidden Costs That Increase Your Premium

Location-Based Surcharges:

- Downtown/Midtown: +$3-5/month (higher crime)

- Westside flooding zones: +$2-4/month (weather risk)

- Older building (pre-1980): +$1-3/month (safety features)

Credit Score Impact:

- Excellent (750+): Base rate

- Good (700-749): +5-8% premium

- Fair (650-699): +15-20% premium

- Poor (<650): +25-35% premium

10 Proven Ways to Lower Your Houston Renters Insurance Premium

Immediate Money-Saving Strategies

1. Bundle and Save Big (Up to 25% Off)

- Auto + Renters: Average savings $200-300/year

- Multiple policies: Additional 5-10% discount

- Real Example: Bundle saves Houston renters average $18/month

2. Smart Deductible Selection

- $500 deductible: Higher monthly cost, lower out-of-pocket

- $1,000 deductible: Save 15-20% on premiums

- $2,500 deductible: Save 25-30% (only if you have emergency fund)

3. Safety Feature Discounts (Stack Multiple Savings)

- Smoke detectors: 5% discount

- Security system: 10-15% discount

- Deadbolt locks: 3-5% discount

- Fire extinguisher: 2-3% discount

- Maximum combined savings: Up to 25% off

4. Credit Score Optimization

- Improving credit from 650 to 750 saves $50-80/year

- Pay bills on time for 6 months = noticeable improvement

- Monitor credit through free services

5. Claims-Free History Bonus

- 3+ years no claims: 5-10% discount

- 5+ years no claims: 10-15% discount

- 10+ years no claims: 15-20% discount

Advanced Premium Reduction Tactics

6. Professional Discounts

- Teachers/educators: 5-8% discount

- Healthcare workers: 3-5% discount

- Military/veterans: 10-15% discount

- Senior citizens (55+): 5-10% discount

7. Payment Method Optimization

- Annual payment: Save $20-40/year vs. monthly

- Auto-pay setup: Additional $10-15/year savings

- Paperless billing: $5-10/year savings

8. Coverage Limit Right-Sizing

- Don’t over-insure: Adjust coverage to actual belongings value

- Don’t under-insure: Ensure adequate replacement cost coverage

- Sweet spot: 110-120% of actual belongings value

9. Regular Policy Shopping

- Shop every 2 years: Rates change significantly

- Life changes trigger: New job, marriage, major purchases

- Average savings: $30-60/year by switching companies

10. Group/Affinity Discounts

- Alumni associations: 5-8% discount

- Professional organizations: 3-5% discount

- Employer partnerships: Varies by company

Does Renters Insurance Cover Flood Damage? (Critical Houston Information)

The $15,000 Wake-Up Call

Hurricane Beryl demonstrated that standard renters insurance doesn’t cover flood damage, leaving many Houston renters with devastating out-of-pocket costs.

Standard Renters Insurance DOES NOT Cover:

- Hurricane storm surge

- Flash flooding from bayous

- Sewer backup (usually)

- Ground water seepage

What You Need Instead:

NFIP Flood Insurance for Renters

Coverage Limits:

- Personal property: Up to $100,000

- Average cost in Houston: $200-750/year depending on flood zone

Flood Zone Breakdown:

- High-risk zones (A, AE): $400-750/year

- Moderate-risk zones (B, C, X): $200-400/year

- Low-risk zones: $150-250/year

Private Flood Insurance Alternatives

Advantages over NFIP:

- Higher coverage limits available

- Faster claims processing

- More comprehensive coverage options

- Potentially lower costs in some areas

Average Private Flood Costs: $180-650/year

What Should Renters Insurance Cost for $100,000 Coverage?

Enhanced Coverage Analysis

For renters with valuable belongings, $100,000 coverage typically costs:

Monthly: $28-36

Annual: $336-432

Who Needs This Level:

- Luxury apartment renters (River Oaks, Galleria area)

- High-value electronics/jewelry owners

- Work-from-home professionals with expensive equipment

- Young professionals with significant wardrobes/furniture

Cost-Benefit Analysis

$100K Coverage Investment: $336-432/year

Potential Claim Value: Up to $100,000

ROI Protection: 23,500-29,700% return on single major claim

Hurricane Preparedness: What Houston Renters Must Know

Lessons from Hurricane Beryl 2024

Hurricane Beryl’s $2.8 billion in damages highlighted critical coverage gaps for Houston renters:

What Was Covered:

- Wind damage to personal property

- Food spoilage from power outages (with endorsement)

- Temporary housing costs

- Tree damage to belongings

What Wasn’t Covered:

- Flood damage from storm surge

- Generator fuel costs

- Lost wages from business closure

- Vehicle damage (requires auto coverage)

Hurricane Deductible Reality

Special Hurricane Deductibles:

- Percentage-based: 1-5% of coverage amount

- Example: $50,000 coverage = $500-2,500 hurricane deductible

- When it applies: Named storms, typically June-November

Neighborhood-Specific Insurance Considerations

Houston Area Risk Assessment by Neighborhood

HIGH-RISK (Higher Premiums)

- Downtown/Midtown: Crime + hurricane exposure

- East End: Flood risk + older infrastructure

- Third Ward: Property crime concerns

- Galveston Bay area: Hurricane + flood risk

MODERATE-RISK (Standard Rates)

- Heights: Mixed risk profile

- Montrose: Crime balanced by community watch

- Medical Center: Heavy traffic, moderate crime

LOWER-RISK (Potential Discounts)

- Bellaire: Low crime, newer construction

- West University: Affluent area, good infrastructure

- Sugar Land suburbs: Low crime, flood protection

Apartment Complex Risk Factors

Higher-Risk Properties:

- Built before 1990 (hurricane codes)

- No gated access

- Limited security lighting

- Ground-floor units in flood zones

Lower-Risk Properties:

- Gated communities with security

- Second floor or higher units

- Modern construction (post-2005)

- On-site management

Business Use and Work-From-Home Coverage

Remote Work Equipment Protection

With 40% of Houston renters working remotely, equipment coverage is crucial:

Standard Coverage Limits:

- Business equipment: Usually $2,500-5,000 maximum

- Home office setup: Often requires endorsement

- Client property: Typically excluded

What You’ll Pay Extra:

- Business property endorsement: +$50-150/year

- Increased equipment limits: +$25-75/year

Real Scenario: Houston marketing professional’s home office equipment (valued at $8,500) requires specialized coverage beyond standard policy limits.

Claims Process: What to Expect in Houston

Average Claims Timeline

Documentation Phase: 1-3 days

- Photo evidence gathering

- Police reports (if applicable)

- Inventory creation

Initial Assessment: 3-7 days

- Adjuster contact

- Damage evaluation

- Coverage verification

Settlement: 10-30 days

- Investigation completion

- Payment processing

- Disputes resolution

Houston-Specific Claims Considerations

Weather-Related Claims Surge:

- Post-hurricane claims: 300-500% increase in volume

- Processing delays: 2-4 weeks additional time

- Documentation requirements: More stringent evidence needed

FAQs: Houston Renters Insurance

How much is renters insurance in Houston per month?

Houston renters insurance costs $16-26 per month ($192-312 annually) depending on coverage level and location. This is 47% higher than the Texas average due to hurricane risk, flooding exposure, and higher crime rates in urban areas.

Do I need flood insurance as a Houston renter?

Yes, absolutely. Standard renters insurance excludes flood damage, and Houston’s flat geography plus 322,000 homes in FEMA flood zones create significant risk. Texas law now requires landlords to disclose flood risks, highlighting the importance of separate flood coverage costing $200-750/year.

Can my landlord require renters insurance in Texas?

Yes, Texas landlords can require renters insurance with minimum liability coverage (typically $100,000-300,000). However, they cannot mandate specific companies or excessive coverage amounts. About 85% of Houston apartment complexes now require proof of coverage before move-in.

What happens if I don’t have renters insurance in Houston?

Without coverage, you’re personally liable for replacing all belongings after disasters. Recent examples include Hurricane Beryl victims paying $15,200+ out-of-pocket and apartment fire victims losing $23,800+ in personal property. You’ll also face potential lawsuits if guests are injured in your rental.

How much should I budget for renters insurance as a college student?

Houston college students should budget $16-24/month for basic coverage. Students living off-campus in higher-crime areas (like Third Ward) may pay $24-28/month, while those in safer neighborhoods (Rice Village) might pay $18-22/month. Bundle with auto insurance for additional savings.

Take Action: Protect Your Houston Rental Today

Bottom Line: Houston renters face unique risks that make insurance essential, not optional. At just $16-26/month, you’re protecting against potential $15,000-50,000 in out-of-pocket costs from hurricanes, flooding, theft, or accidents.

Your Next Steps:

- Get Multiple Quotes: Compare at least 3 providers for best rates

- Calculate Belongings Value: Use our inventory checklist to determine coverage needs

- Consider Flood Coverage: Evaluate your flood zone risk and add protection

- Review Annually: Adjust coverage as belongings and circumstances change

- Document Everything: Create photo/video inventory before you need it

Ready to protect your Houston home? Contact Hotaling Insurance Services today for personalized quotes from top-rated carriers. Our Houston specialists understand local risks and can help you find the perfect balance of coverage and affordability.

Free consultation includes:

- Personalized coverage recommendations

- Flood zone risk assessment

- Bundle discount analysis

- Claims support planning

Related Houston Insurance Guides

Disclaimer: This article provides general information only and does not constitute financial or insurance advice. Insurance requirements, coverage options, and costs vary by individual circumstances. Consult with licensed insurance professionals for personalized recommendations. Coverage terms, conditions, and exclusions vary by insurer and policy. All cost estimates based on October 2025 market analysis and subject to change.

Last Updated: October 6, 2025 | Next Review: April 2026 or after significant weather events