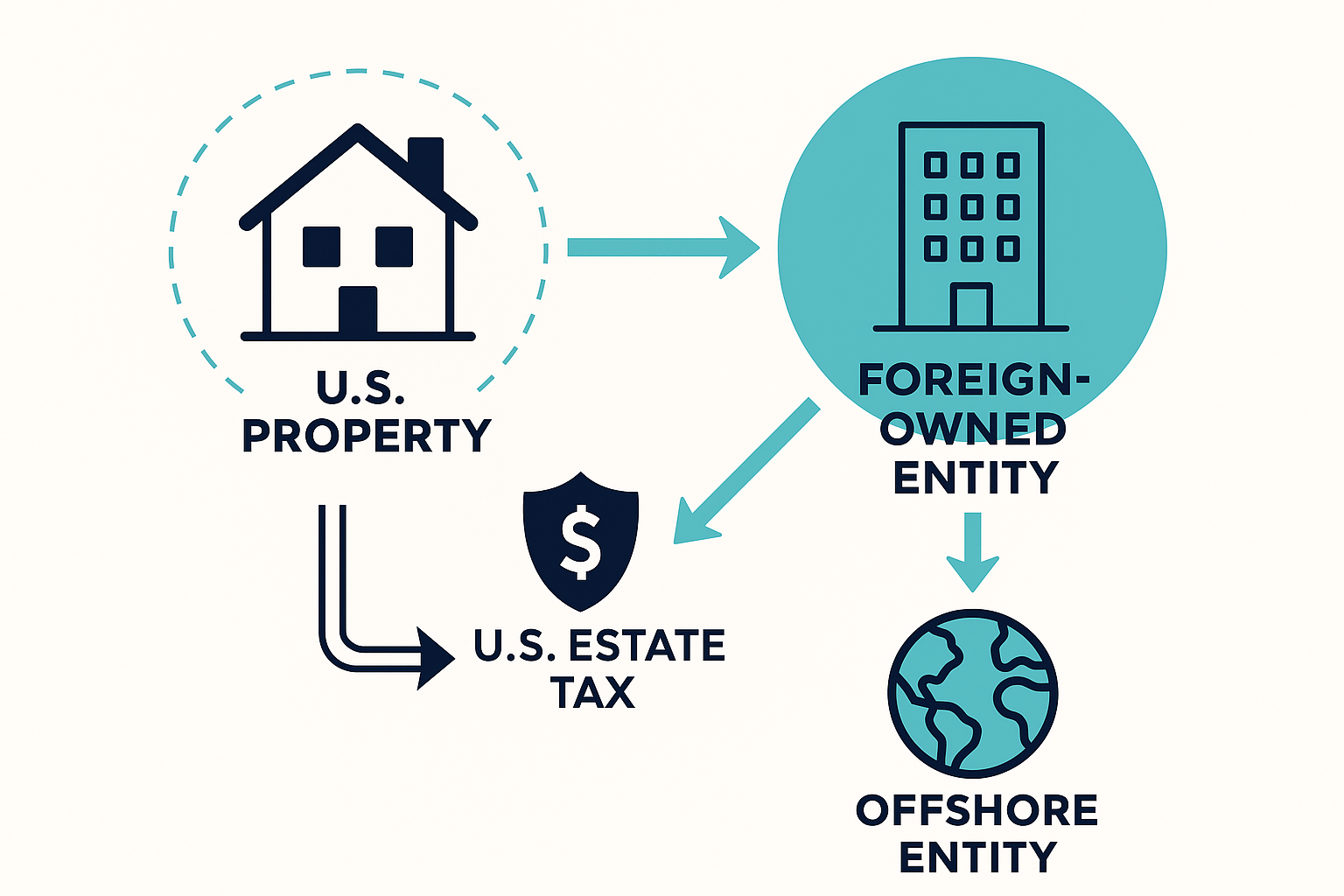

Estate Tax Planning Loophole for Foreign Nationals

Reading Time: 6 minutesReading Time: 6 minutes Estate Tax Loophole for Foreign Nationals Estate Tax Loophole planning for nonresident aliens begins with one crucial fact: foreign nationals owe U.S. estate tax only on their U.S.–situs assets—real estate, tangible personal property, and U.S. corporate shares. With just a $60,000 exemption for non-U.S. citizens versus a $13.99 million exemption for […]