Estate Tax Loophole for Foreign Nationals

Estate Tax Loophole planning for nonresident aliens begins with one crucial fact: foreign nationals owe U.S. estate tax only on their U.S.–situs assets—real estate, tangible personal property, and U.S. corporate shares. With just a $60,000 exemption for non-U.S. citizens versus a $13.99 million exemption for U.S. citizens in 2025, even modest holdings can trigger significant liabilities. This comprehensive two-thousand-word guide delivers a blueprint of advanced cross-border tax planning tactics—from entity structuring and lifetime gifting to digital-asset management, PFIC elections, QDOT implementation, state-level coordination, and treaty elections—to preserve wealth, optimize nonresident exemptions, and exploit every lawful strategy to minimize U.S. estate tax exposure.

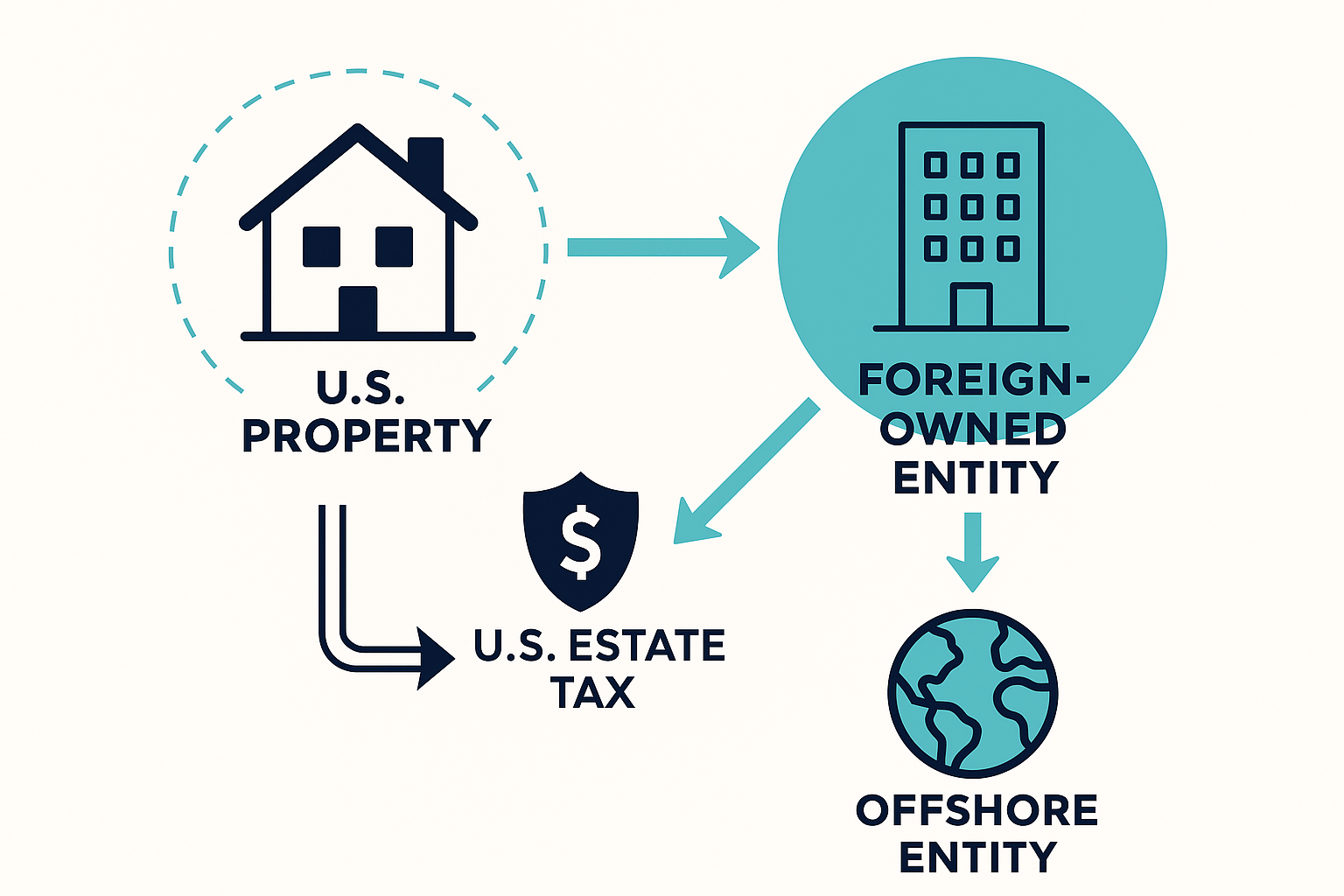

Entity Structuring: The Core Estate Tax Strategy

A. Foreign-Owned Entities

Holding U.S. real estate or personal property through a foreign corporation or partnership transforms direct ownership into an intangible equity interest. That interest generally escapes U.S. estate tax. Key steps:

-

Transfer into an offshore entity (e.g., LLC or partnership)

-

Issue shares or partnership units to the nonresident owner

-

Obtain professional appraisals of the entity’s equity

-

Draft robust operating agreements to avoid U.S. “look-through” rules or inadvertent grantor-trust status

Example:

A Singaporean investor transfers a Texas rental home into a Cayman LLC. The investor holds LLC units instead of the property. On death, only the offshore LLC units—treated as intangible—are in the U.S. estate. Coupled with a treaty election, this structure can match U.S. citizen exemption levels and dramatically reduce estate tax.

B. Gifting Intangibles to Shrink the Taxable Estate

Gifting non-U.S. situs intangibles—foreign-registered securities, private equity interests, or trust shares—during life can remove millions from the taxable estate without U.S. gift or estate tax:

-

Annual exclusion gifts: $17,000 per recipient (2024 rate)

-

Lifetime gifts under treaties: Leverage country-specific exemptions

-

Documentation: Formal gift agreements and independent valuations

-

Charitable strategies: Combine gifts with charitable remainder trusts for immediate income-tax deductions

This nonresident exemption planning approach gradually reduces estate size while retaining effective control.

C. Treaty Elections to Amplify Exemptions

The U.S. has estate-tax treaties with 17 countries (Canada, France, Germany, Japan, etc.) that allow residents of those nations to claim a pro rata share of the full unified credit. By filing Form 706-NA and a Transfer Certificate Request, nonresidents can boost their exemption from $60,000 to several million dollars—often matching the U.S. citizen level. Critical steps include:

-

Document residency: Local tax returns, utility bills

-

Obtain legal opinions: Confirm treaty applicability

-

File timely IRS forms: Include all required schedules

Digital Assets & Cryptocurrency

A. Inventory & Access Under RUFADAA

Digital holdings—cryptocurrencies, NFTs, domain names, and cloud accounts—are easily overlooked yet often substantial. Under the Revised Uniform Fiduciary Access to Digital Assets Act, fiduciaries can access digital property if the decedent provided written authorization. Best practices:

-

Compile a secure inventory: Wallet addresses, exchange logins, private keys

-

Use multi-signature wallets: Protect assets and streamline transfer

-

Include hardware-wallet recovery instructions: Ensure access

B. Updating Estate Documents & Online Tools

Ensure wills, trusts, and digital-asset riders explicitly grant fiduciaries authority over electronic property. Leverage platform-level tools:

-

Google Inactive Account Manager

-

Facebook Legacy Contact

Embedding these provisions in your cross-border tax planning guarantees digital assets can be liquidated quickly for tax payments or distributions.

C. Valuation & Tax Reporting Requirements

Executors must:

-

Include digital assets in the gross estate at fair market value on date of death

-

Report post-death income on Form 1041 if the estate generates revenue

-

File Form 8937 for PFIC-structured tokens, if applicable

-

Engage qualified appraisers for illiquid NFTs or private tokens to preserve step-up basis benefits

State-Level Estate & Inheritance Taxes

A. Overview of State Regimes & Exemptions

Twelve states plus D.C. impose estate taxes (exemptions $1 million–$13.99 million) and some levy inheritance taxes on beneficiaries receiving property. Coordinating federal and state filings is essential to prevent double taxation and late-filing penalties—core components of an effective estate tax loophole plan provided by Hotaling Insurance Services.

B. Nexus & Situs Triggers for Nonresidents

Direct ownership of in-state real property or personal property (art, vehicles, equipment) creates state nexus. State domicile tests vary:

-

New York: Last declared residence

-

California: Primary home

Mapping these triggers is critical for thorough nonresident estate tax planning.

C. Federal Credit Coordination

State estate taxes paid may offset federal liability when properly reported on Form 706. Techniques include:

-

Entity layering: Single-member LLCs or statutory trusts

-

Centralized filings: Simplify multi-state compliance

These measures support a unified estate tax strategy.

Generation-Skipping Transfer (GST) Tax

A. GST Tax Fundamentals

The GST tax imposes a 40% levy on transfers to “skip” beneficiaries (grandchildren, unrelated heirs) above a $13.99 million lifetime exemption. Unallocated exemption triggers punitive flat rates, undermining the estate tax loophole.

B. Exemption Allocation Techniques

Preserve exemption capacity by timely Form 709 elections:

-

Allocate to dynasty trusts or specific bequests

-

Make annual nominal allocations

C. Dynasty Trusts for Long-Term Planning

Multi-generational dynasty trusts shelter appreciation from estate and GST taxes. Include decanting powers and flexible distribution provisions to adapt to future law changes—preserving your core estate tax strategy over decades.

Qualified Domestic Trusts (QDOTs) & Spousal Strategies

A. QDOT Requirements & Mechanics

A QDOT allows a non-U.S. spouse to claim the unlimited marital deduction. Key elements:

-

U.S. trustee with bond and withholding authority

-

Qualifying security to cover estate tax

-

Timely election on Form 706-NA

Ongoing QDOT administration—annual returns and corpus withholding—is mandatory.

B. Alternative Spousal Techniques

For modest assets, consider:

-

Joint tenancy with right of survivorship

-

Tenancy-in-common

These methods can transfer property without estate tax but may trigger gift taxes and cede control. Use alongside QDOTs, gifting, and treaty strategies for optimal spousal planning.

Fiduciary Withholding & Income Tax Filings

A. Form 1041 vs. Form 1040-NR

Nonresident estates with over $600 of U.S. source income must file Form 1041. Distributions to foreign beneficiaries often require withholding at 30% unless reduced by treaty and may trigger Form 1040-NR filings by beneficiaries.

B. Withholding Optimization Strategies

Use advanced structures to centralize obligations:

-

Section 1444 notice partners

-

U.S. grantor trusts

Proper classification, treaty documentation, and timely elections minimize over-withholding and compliance risk.

Gift-Tax Treaty Strategies

A. Treaty Coverage & Filing Requirements

U.S. gift-tax treaties with nine countries parallel estate-tax treaties. Nonresidents file Form 709 with treaty-position statements to claim exemptions on non-U.S. situs gifts.

B. Sequencing Gifts for Maximum Impact

Maximize benefits by:

-

Sequencing annual exclusion gifts of shares

-

Leveraging lifetime exemption under treaties

-

Employing foreign grantor trusts

This multi-tiered approach is a cornerstone of effective estate tax strategy.

PFIC & Offshore Investment Mitigation

A. PFIC Regime Overview

Passive Foreign Investment Companies trigger an “excess distribution” regime with punitive interest charges unless a Qualified Electing Fund (QEF) or mark-to-market election is made. Built-in gains above 125% of prior-year basis can dramatically inflate tax.

B. Mitigation Techniques

Key tactics include:

-

Migrating holdings to non-PFIC vehicles

-

Making catch-up QEF elections

-

Transferring shares into grantor trusts

These steps are essential to a robust estate tax loophole plan.

Private Placement Life Insurance (PPLI) Structures

A. PPLI Overview

PPLI combines diversified investments with a life insurance wrapper, offering tax-deferred growth and estate exclusion. The death benefit passes to heirs tax-free and policy loans provide pre-death liquidity.

B. Suitability & Integration

Typically requires $5 million+ net worth and sufficient liquidity. Pairing PPLI with foreign trust structures achieves multi-jurisdictional deferral and enhances overall planning flexibility.

Concrete Case Studies

-

$1 Million U.S. Real Estate

-

Direct Ownership: $940K net equity × 40% = $376K estate tax

-

Foreign Entity: Lower corporate rates → $200K+ savings

-

QDOT: Deferral until spouse’s death; bond equals liability

-

-

$500K Life Settlement

-

Cash Surrender: $50K (10% face)

-

Life Settlement: $60K net $55K after fees

-

PPLI Option: Defer tax, retain death benefit

-

-

$3 Million Dynasty Trust

-

GST Exemption Use: Avoids 40% on $6 million growth = $2.4 million saved

-

Who Can Use This Loophole and Why

A. Eligible Individuals

-

Nonresident Aliens

-

Foreign nationals holding any U.S.-situs assets—real estate, vacation homes, rental properties, tangible personal property, or shares in U.S. corporations.

-

-

Cross-Border Business Owners & Investors

-

Entrepreneurs or investors with U.S. holdings who want to minimize U.S. estate tax exposure on business interests or securities.

-

-

High-Net-Worth Families

-

Individuals with multi-jurisdictional portfolios seeking to preserve family wealth and streamline multi-generational transfers.

-

-

Digital-Asset Holders

-

Those with significant cryptocurrency or NFT positions who need clear fiduciary access and valuation plans under RUFADAA.

-

B. Key Motivations & Benefits

-

Maximize Exemptions

-

Leverage entity structuring, gifting, and treaty elections to boost effective exemption from $60,000 to millions.

-

-

Preserve Wealth

-

Reduce or eliminate estate tax on U.S.-situs assets, allowing heirs to inherit more of your legacy.

-

-

Simplify Administration

-

Centralize ownership via offshore entities and clear digital-asset protocols to avoid probate delays and compliance headaches.

-

-

Cross-Generational Planning

-

Use GST strategies and dynasty trusts to protect appreciation from estate and GST taxes over multiple generations.

-

-

Spousal Protection

-

Ensure non-U.S. spouses can claim marital deductions via QDOTs, avoiding unintended tax burdens on surviving partners.

-

Hotaling Insurance Services specializes in guiding nonresident aliens through each of these strategies—helping you decide which combination of entity structures, gifting techniques, and trust vehicles best fits your unique circumstances.

Conclusion & Next Steps

By integrating foreign-entity structuring, lifetime gifting, treaty elections, digital-asset management, PFIC mitigation, QDOT implementation, state coordination, gift-tax treaties, and PPLI strategies, you now have a complete blueprint for an effective Estate Tax Loophole.

Next steps:

-

Engage a qualified cross-border tax advisor

-

Inventory and legalize digital assets under RUFADAA

-

Secure digital-asset consents

-

File Forms 706-NA, 709, and QEF elections timely

-

Implement QDOT or alternative spousal arrangements

-

Leverage PPLI where appropriate

For ongoing insights on nonresident estate tax planning, visit Hotaling Insurance Services’ News & Blog.

Sources

-

Unlocking the Benefits of PPLI Insurance in Miami

https://hotalinginsurance.com/news/unlocking-the-benefits-of-ppli-insurance-in-miami hotalinginsurance.com -

What Happens to Debt After You Die? Unknown Facts

https://hotalinginsurance.com/news/what-happens-to-debt-after-you-die-unknown-facts hotalinginsurance.com -

How to Determine the Worth of Your Life Insurance Policy

https://hotalinginsurance.com/news/how-to-determine-the-worth-of-your-life-insurance-policy hotalinginsurance.com -

Is Life Insurance a Waste of Money? Depends on Your Risk

https://hotalinginsurance.com/news/is-life-insurance-is-a-waste-of-money-depends-on-your-risk hotalinginsurance.com -

Connelly Case Life Insurance: Policy Change Summary

https://hotalinginsurance.com/news/connelly-case-life-insurance-policy-change-summary hotalinginsurance.com