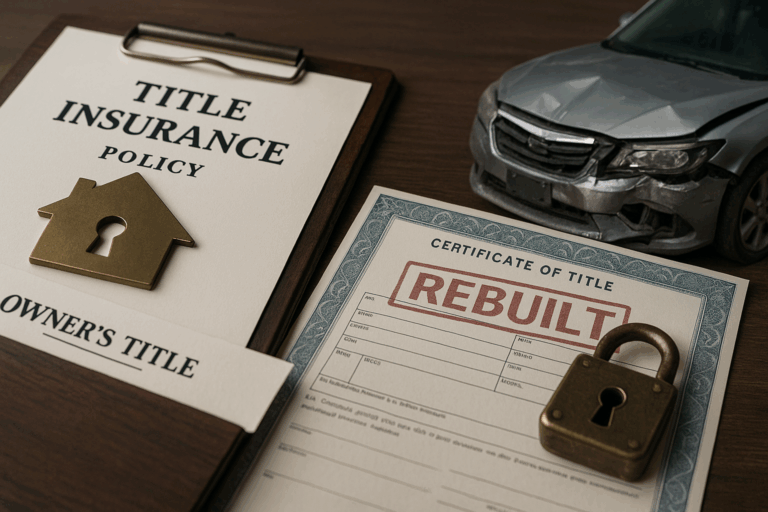

Rebuilt Title Insurance & Title Companies For Buyers

Introduction: Don’t Let Ignorance Cost You Ownership

Let’s cut to the truth: if you’re about to buy a house, sign a contract, or drop thousands on a used car—you need to understand what a title is.

This isn’t optional. This isn’t “nice to know.” If you don’t get this right, you can lose your property, your investment, or your financial peace of mind—and that’s on you.

Too many people treat title insurance like a boring afterthought. It’s not. It’s the legal and financial armor that protects your legacy.

In this article, we’re cutting through the noise. You’ll understand:

-

What a title really is.

-

What a title company does (and doesn’t do).

-

Why title insurance isn’t a scam—it’s a shield.

-

How rebuilt vehicle titles affect your bottom line.

-

And how to make every real estate decision with certainty and control.

Let’s go.

What Is a Title? (And Why It’s Your Foundation)

A title is the invisible backbone of ownership. It’s not just a document—it’s the legal chain of trust that says: You own this.

In real estate, the title is proof that your property belongs to you and no one else.

In the automotive world, the title certifies who owns the vehicle. It’s how states track, transfer, and verify ownership. It’s the gatekeeper to what you can claim, sell, or protect.

Title vs. Deed

-

Title = Ownership rights.

-

Deed = The document that transfers those rights.

You can’t control what you don’t legally own. And you can’t sell what you don’t have clear title to.

Rebuilt Titles: The Hidden Risk in Used Cars

Let’s talk cars.

A clean title means the car has never been wrecked, totaled, or flooded.

A salvage title means the insurance company declared it a total loss. It’s been through the fire.

A rebuilt title means someone tried to resurrect it—fixing it up, passing inspections, and sending it back on the road.

But here’s the catch: Insurance companies don’t trust rebuilt titles. Many will:

-

Jack up your premiums

-

Limit your coverage

-

Or flat-out refuse to insure it

Bottom line: Yes, a rebuilt title affects insurance, it affects resale value, reliability, and peace of mind. Choose wisely.

2. What Is a Title Company? Know Who’s Protecting You

If a title is the foundation, a title company is the inspector, the bodyguard, and the detective—rolled into one.

Here’s what they actually do:

Core Responsibilities

-

Title Search – They dig into public records to find red flags: unpaid taxes, forged documents, missing heirs, liens, boundary disputes—you name it.

-

Escrow Services – They hold the money, the deed, the documents—making sure nobody gets played before the deal closes.

-

Title Insurance – They issue policies that back you up financially if something slips through the cracks.

Real Talk Example

You buy a home. Six months later, a contractor sues you over an unpaid bill from the previous owner. The lien wasn’t on the title search.

If you don’t have insurance, you’re on the hook. If you do? You’ve got backup. Legal coverage. Peace of mind.

3. What Is Title Insurance (And Why It’s a Non-Negotiable)

Let’s get this straight—title insurance is not a scam. It’s not some throwaway fee you “probably won’t use.”

It’s the legal and financial equivalent of defensive training. You hope you never need it, but if the time comes, it saves your entire investment.

What Does Title Insurance Cover?

-

Clerical errors in public records

-

Fraudulent paperwork

-

Forged signatures

-

Undisclosed liens

-

Unknown heirs

-

Boundary disputes

It doesn’t matter how thorough the title search is—things get missed. Title insurance steps in when the system fails.

4. How Much Is Title Insurance? A One-Time Price for Lifelong Protection

You’re not paying monthly. You’re not renewing it every year. You pay once at closing—and it lasts as long as you own the home.

U.S. Averages

| Home Price | Premium Estimate |

|---|---|

| $100,000 | ~$832 |

| $250,000 | ~$1,500 |

| $500,000 | ~$2,700 |

Texas: State-Regulated Rates

In Texas, the Department of Insurance sets the rates. Everyone charges the same. No guesswork, no games.

Still think it’s expensive? Compare that to the cost of hiring a lawyer when someone contests your ownership. Title insurance is a steal.

5. Common Misconceptions That Cost People Big

Myth #1: The Lender’s Title Policy Covers Me

Nope. That policy protects them, not you. If you want personal protection, get your own owner’s policy.

Myth #2: Escrow and Title Companies Are the Same Thing

Not even close. Escrow handles funds. Title companies verify ownership and insure your claim.

Myth #3: Rebuilt Titles Only Affect Cars

True. But the mindset applies everywhere: If ownership isn’t clear, risk skyrockets—whether it’s a car or a house.

6. Rebuilt Titles and Insurance: The Brutal Truth

Insurance companies are in the risk business. A rebuilt title screams high risk.

-

They assume there’s hidden damage.

-

They assume resale is lower.

-

They assume the repairs were just enough to pass inspection.

Some carriers only offer liability insurance for rebuilt titles. Others deny coverage altogether.

Key Insight: If you’re buying a car with a rebuilt title, assume higher costs and limited protection. Walk into that deal with eyes wide open.

7. You Can Choose Your Title Company. So Choose Smart.

Under RESPA, buyers have the legal right to pick their own title company. Don’t let a lazy agent or lender make that call for you.

Why You Should Care

-

Some companies use outdated systems.

-

Some charge unnecessary “junk fees.”

-

Some miss things that cost you thousands.

✅ Checklist: Ask These 5 Questions

-

Do you offer bundled pricing?

-

Can I see your public record error rate?

-

What’s your digital closing process like?

-

Do you monitor for post-closing issues?

-

How quickly can you deliver the title commitment?

Conclusion: Own Your Legacy, Don’t Gamble It

Look—property ownership isn’t just a milestone. It’s leverage. It’s security. It’s legacy.

And it begins with clarity.

-

Know what a title is.

-

Know what a title company actually does.

-

Know why title insurance isn’t optional.

-

Know how rebuilt titles can hurt your wallet.

-

And most of all—know that ownership without protection is just wishful thinking.

Protect your house. Protect your car. Protect your future.

FAQ Section

What does a title company do during closing?

They manage escrow, verify ownership, and issue insurance—your three lines of defense.

Can I choose my own title company as a buyer?

Yes. And you should. Never outsource that decision.

How much does title insurance cost in Texas?

State-regulated. ~$832 for $100k home, ~$2,700 for $500k. One-time payment, lifetime peace of mind.

Will a rebuilt title make my car insurance go up?

Yes. Most carriers will hike premiums or restrict coverage. Some won’t insure it at all.

What’s the difference between a title and a deed?

The title is your right to ownership. The deed is the proof that you got it.

Need To Know More?

-

Unlocking the Benefits of PPLI Insurance in Miami

https://hotalinginsurance.com/news/unlocking-the-benefits-of-ppli-insurance-in-miami hotalinginsurance.com -

What Happens to Debt After You Die? Unknown Facts

https://hotalinginsurance.com/news/what-happens-to-debt-after-you-die-unknown-facts hotalinginsurance.com -

How to Determine the Worth of Your Life Insurance Policy

https://hotalinginsurance.com/news/how-to-determine-the-worth-of-your-life-insurance-policy hotalinginsurance.com -

Is Life Insurance a Waste of Money? Depends on Your Risk

https://hotalinginsurance.com/news/is-life-insurance-is-a-waste-of-money-depends-on-your-risk hotalinginsurance.com -

Connelly Case Life Insurance: Policy Change Summary

https://hotalinginsurance.com/news/connelly-case-life-insurance-policy-change-summary hotalinginsurance.com -

Guide to Insuring Salvage and Rebuilt Title Vehicles (RideSafely)

In-depth and state-specific guidance on rebuilt/salvage insurance, inspection requirements, and coverage tips—ideal for fleshing out your rebuilt title insurance details insurify.com+4auction.ridesafely.com+4hotalinginsurance.com+4. -

How to Insure a Rebuilt Title Car (Policygenius)

Highlights major insurers, challenges for flood-restored vehicles, and limited coverage options—excellent for authority and depth. -

Rebuilt Car Title: What It Is, Pros and Cons (Investopedia)

Provides valuation differences, forensic advice (e.g., VINCheck), pros/cons comparisons—adds credibility to your rebuilt title assessment auction.ridesafely.com+4investopedia.com+4hotalinginsurance.com+4. -

Vehicle Title Branding (Wikipedia)

Legal overview of branding rules, cross-state title washing issues, and consumer protection rationale—supports your warnings against rebuilt-title scams.