What Does Property and Casualty Insurance Cover?

Reading Time: 21 minutesWhat Does Property and Casualty Insurance Cover? Enterprise Coverage Guide Property and casualty insurance for enterprises encompasses comprehensive protection addressing both physical asset exposure and liability risk across multi-jurisdictional operations. For organizations managing $20M-$200M+ revenue, understanding P&C coverage components determines whether your insurance program adequately protects against operational disruption, regulatory penalties, and catastrophic loss events. […]

What is Property and Casualty Insurance? Complete Guide

Reading Time: 10 minutesProperty and Casualty Insurance: Enterprise Risk Management Guide Property and casualty insurance (P&C) provides comprehensive protection for corporate assets and liability exposure across multi-jurisdictional operations. For enterprises managing $20M-$200M+ revenue, P&C insurance encompasses general liability, commercial property, excess liability, and specialized coverages protecting against business interruption, regulatory penalties, and catastrophic loss events. For more details, […]

Host Liquor Liability Insurance for Corporate Events with Venezuelan Business Partners

Reading Time: 12 minutesHost Liquor Liability Insurance for Corporate Events with Venezuelan Business Partners Hosting corporate events with Venezuelan business partners where alcohol is served creates host liquor liability exposures. Houston energy companies need specialized coverage protecting against third-party injuries, auto accidents, and assault claims arising from intoxicated guests at business functions. Quick Insights: Host Liquor Liability Coverage […]

Products-Completed Operations Insurance for Oilfield Equipment Manufacturers Shipping to Venezuela

Reading Time: 13 minutesProducts-Completed Operations Insurance for Oilfield Equipment Manufacturers Shipping to Venezuela Venezuela oilfield equipment exports create products liability exposures through manufacturing defects, installation failures, inadequate warnings, and design errors. Manufacturers need specialized products-completed operations coverage extending beyond domestic work to protect against catastrophic equipment failure claims in aging infrastructure. Quick Insights: Products-Completed Operations Coverage Coverage Basis: […]

Houston Energy Companies Expanding to Venezuela: Get General Liability Insurance

Reading Time: 13 minutesHouston Energy Companies Expanding to Venezuela: Commercial General Liability Our Insurance Guide Houston energy companies pursuing Venezuela’s $58 billion oil infrastructure opportunity face massive liability exposures. Standard commercial insurance excludes international energy operations. Specialized general liability coverage protects drilling contractors, equipment manufacturers, joint ventures, and corporate facilities from catastrophic losses. Quick Insights: Venezuela Operations GL […]

Contractual Liability Insurance Protecting Houston Firms in Venezuela Joint Venture Agreements

Reading Time: 8 minutesContractual Liability Insurance Protecting Houston Firms in Venezuela Joint Venture Agreements Venezuela joint ventures create complex contractual liability exposures through indemnification agreements, hold harmless provisions, and shared liability with PDVSA partners. Houston energy companies need specialized general liability coverage addressing these obligations that standard commercial policies inadequately protect. Quick Insights: Joint Venture Liability Insurance Average […]

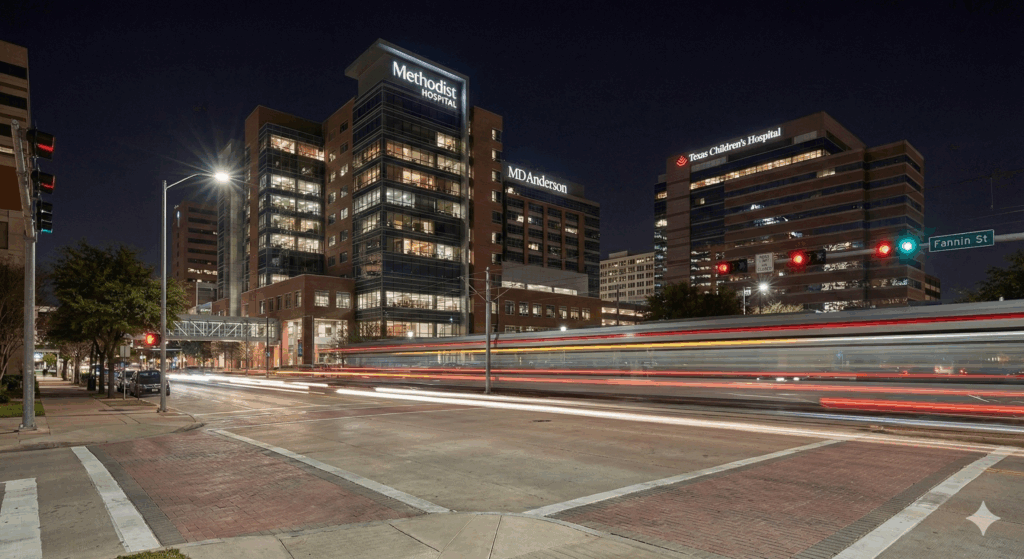

Medical Malpractice Insurance for TMC Physicians

Reading Time: 6 minutesWhen TMC Physicians Need Individual Malpractice Insurance – Hotaling Insurance Services Need Medical Malpractice Insurance and work at TMC in Houston? Even with comprehensive institutional coverage, most TMC physicians need supplemental individual policies for: Who This Guide Is For This guide is written for Texas Medical Center physicians who have accumulated significant personal wealth and […]

Texas Medical Center Malpractice Environment

Reading Time: 8 minutesThe Texas Medical Center Malpractice Environment TMC physicians operate in the most complex healthcare ecosystem in the world. This complexity creates unique liability exposures: Institutional employment structures mean most TMC physicians receive malpractice coverage through their hospital or university employer. MD Anderson provides coverage for faculty oncologists. Baylor College of Medicine covers faculty physicians. Memorial […]

Texas Medical Center Employment to Private Practice Transition

Reading Time: 10 minutes Transitioning from Texas Medical Center Employment to Private Practice The Texas Medical Center is the largest medical complex in the world, housing multiple hospitals, research institutions, and specialty centers. Physicians employed at this Houston medical center face unique malpractice insurance challenges when transitioning to private practice. The move from institutional employment to independent practice requires […]

GL Coverage for Drilling Contractors Working on Venezuelan Infrastructure Projects

Reading Time: 11 minutesGL Coverage for Drilling Contractors Working on Venezuelan Infrastructure Projects Venezuelan drilling infrastructure averages 50+ years old with deferred maintenance creating extreme liability exposures. Drilling contractors need specialized general liability coverage for blowouts, equipment failures, third-party injuries, environmental liability, and completed operations that standard commercial policies explicitly exclude. Quick Insights: Drilling Contractor GL Insurance Average […]