Builders Risk Insurance for Commercial Real Estate Development: Coverage, Costs, and Lender Requirements

Reading Time: 5 minutesReading Time: 5 minutes Builders Risk Insurance for Commercial Real Estate Development: What Your Lender Requires and What Actually Protects Your Investment If you’re developing commercial real estate — whether it’s a $30M office building, a $75M multifamily project, or a $200M mixed-use development — builders risk insurance is the single most important coverage you’ll […]

New Construction Home Insurance Costs | 33% Savings Explained

Reading Time: 7 minutesHomeowners Insurance New Construction: Why New Builds Cost 33% Less to Insure Last Updated: October 16, 2025 With homebuilder confidence surging to its highest level since early 2024 and builders offering unprecedented incentives, savvy homebuyers are discovering that new construction doesn’t just offer modern amenities—it delivers substantial insurance savings that can total thousands annually. Quick […]

PEO for Small Business: Under 100 Employees

Reading Time: 7 minutesPEO for Small Business: Complete Implementation Guide for Companies Under 100 Employees Small Business Reality Check: 78% of small businesses spend over 15 hours weekly on HR tasks instead of growing their companies. PEO partnerships can eliminate this burden while providing Fortune 500-level benefits your competitors can’t match. Small business owners face an impossible choice: […]

Watercraft Insurance Cost

Reading Time: 7 minutesReading Time: 7 minutes Reading Time: 7 minutes Ultimate Guide: Watercraft Insurance Cost Breakdown 2025 Last Updated: October 1, 2025 Quick Insights Box Watercraft insurance costs vary dramatically based on vessel type, coverage level, and location. Personal watercraft insurance averages $200-600 annually, while larger boats can cost $300-1,500 per year. Smart buyers can reduce premiums […]

Personal Watercraft Insurance

Reading Time: 7 minutesReading Time: 7 minutesReading Time: 7 minutes Reading Time: 7 minutes Personal Watercraft Insurance: Coverage Options and Requirements Last Updated: October 1, 2025 Quick Insights Box Personal watercraft insurance protects jet ski, Sea-Doo, and WaveRunner owners against liability claims, theft, and physical damage. Most states require minimum liability coverage for motorized PWCs, with optional comprehensive […]

How to Get Watercraft Insurance Quotes

Reading Time: 7 minutesReading Time: 7 minutesReading Time: 7 minutes Reading Time: 7 minutes How to Get Watercraft Insurance Quotes: Complete Comparison Guide Last Updated: October 1, 2025 Quick Insights Box Getting accurate watercraft insurance quotes requires providing detailed vessel information, usage patterns, and operator history to experienced marine insurance professionals. Hotaling Insurance Services provides quotes within 24-48 […]

How Gap Insurance Transforms Your Employee Benefits Strategy

Reading Time: 5 minutesReading Time: 5 minutesReading Time: 5 minutes How Gap Insurance Transforms Your Employee Benefits Strategy: A Complete Guide for Employers Last Updated: September 30, 2025 Quick Insights Box Gap insurance is revolutionizing how employers manage rising healthcare costs while maintaining competitive benefits packages. These supplemental plans fill coverage gaps in high-deductible health plans, reducing out-of-pocket […]

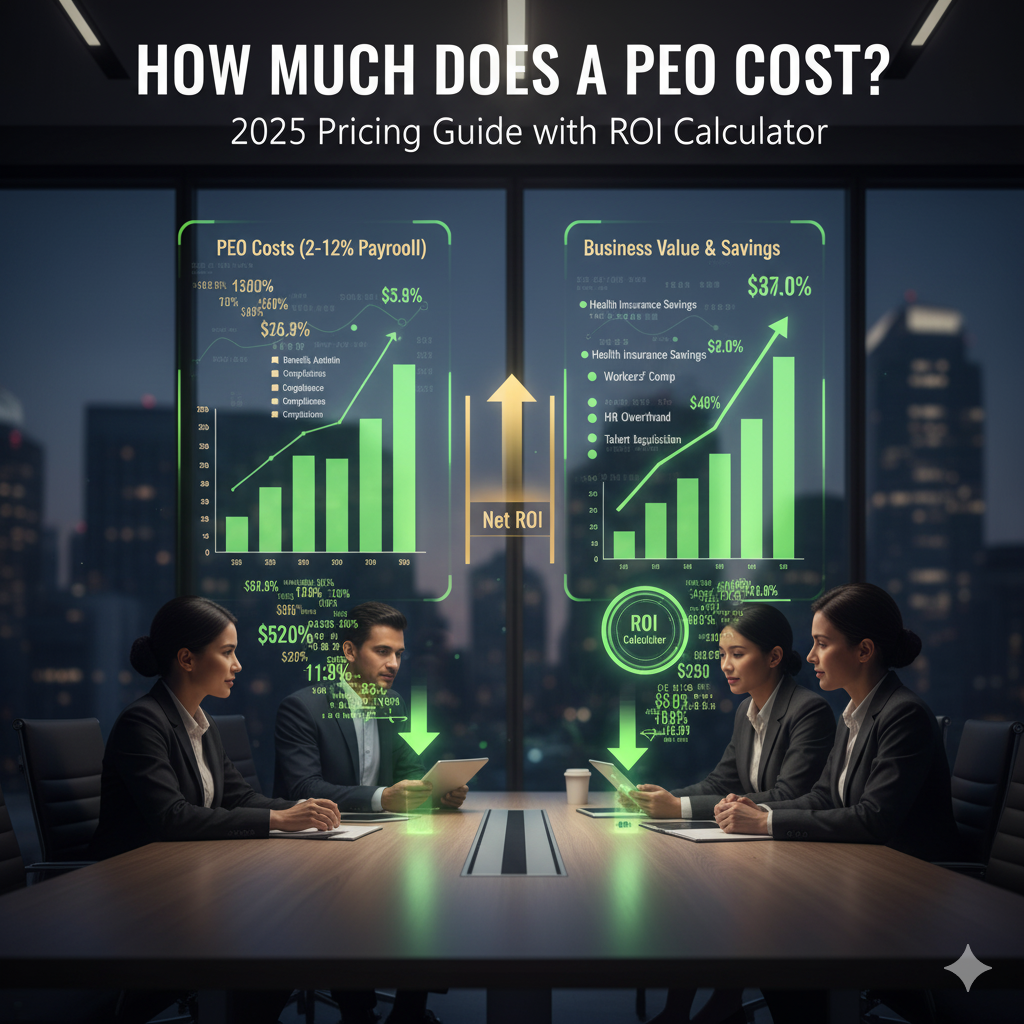

How Much Does a PEO Cost?

Reading Time: 6 minutesReading Time: 6 minutes How Much Does a PEO Cost? 2025 Pricing Guide with ROI Calculator Quick Cost Estimate: PEO services typically cost 2-12% of gross payroll ($150-$300 per employee monthly). For a 25-employee company averaging $50,000 salaries, expect $75,000-$150,000 annually—often less than the true cost of managing HR internally. “How much will this actually […]

PEO vs Payroll Company

Reading Time: 6 minutesPEO vs Payroll Company: Which HR Solution Is Right for Your Business? Quick Decision Guide: Choose a payroll company if you only need basic payroll processing. Choose a PEO if you want comprehensive HR services, better employee benefits, and compliance protection. Most growing businesses (25+ employees) benefit more from PEO partnerships. The choice between a […]

Key Person Insurance Cost

Reading Time: 5 minutes Key Person Insurance Cost: What Happens When Your $3 Million Moneymaker Walks Out the Door? ⚡ Reality Check: Your top salesperson generates 40% of revenue. Your CTO holds all the technical knowledge. Your COO manages every critical relationship. One unexpected departure could cost your business millions. Key person insurance costs pennies compared to […]