Commercial Dump Truck Insurance Guide: Hotaling Insurance Services

Reading Time: 4 minutesReading Time: 4 minutes Commercial Dump Truck Insurance Guide · U.S. Coverage & Cost Updated: July 29, 2025 · Written by the Hotaling Team Key Takeaways Dump-truck insurance is mandatory for hauling gravel, soil, demolition debris or asphalt on public roads. Standard policies bundle auto liability, physical damage, and cargo; optional add-ons cover environmental spills, […]

Architects & Engineers Professional Liability Insurance: 2025 Cost

Reading Time: 4 minutesReading Time: 4 minutes Architects & Engineers Professional Liability Insurance: 2025 Cost, Coverage & Savings Guide Modern projects carry razor-thin margins and “nuclear” verdict risks, so professional liability (a/k/a “errors & omissions”) has become the keystone of architects insurance and engineering insurance programs. Average premiums now run $140–$240 per month for $1 million limits, while […]

Types of Construction Insurance: 2025 Guide for Contractors & Developers

Reading Time: 5 minutesReading Time: 5 minutes Reading Time: 5 minutes Types of Construction Insurance: 2025 Guide for Contractors & Developers Builder’s risk, general liability, workers compensation, inland-marine and contractors pollution liability are the five core types of construction insurance. Each protects a different phase of work and may be bundled to cut total cost of risk by […]

Texas SB 21 Approved in House for State-Run Bitcoin Reserve

Reading Time: 5 minutesReading Time: 4 minutes Reading Time: 4 minutes Texas SB 21 Is Now Law: 2025 Business & Insurance Guide Signed on June 20 2025, the measure establishes America’s first state-managed Bitcoin reserve and requires quarterly proof-of-reserve audits for any custodian serving Texas users. Source Why You Can Trust Hotaling’s Take on SB 21 Experience. Hotaling Insurance […]

Are Annuities a Good Investment: Landon Martinez – Insurance Specialist

Reading Time: 6 minutesAre Annuities a Good Investment: Landon Martinez – Insurance Specialist Updated July 14, 2025 — Written Landon Martinez, Insurance Specialist, Hotaling Insurance Services | Linkedin Author Bio: Are Annuities a Good Investment? I provide tailored insurance solutions for high-net-worth individuals and families—helping them manage rising premiums across life, estate, and personal-lines coverage. Over the past decade […]

When Should You Buy Long-Term Care Insurance?

Reading Time: 5 minutesReading Time: 5 minutes When Should You Buy Long-Term Care Insurance? — Insurance Specialist Insights By Kenneth Hausman – Insurance Specialist, Hotaling Insurance ServicesUpdated July 10 2025 Short answer: Most people lock in coverage between ages 52 and 58—before premiums rise 6–8 percent each year and health issues cause declines. Quick Insights Age 55 is the […]

The Pros and Cons of a Home Equity Loan in Houston

Reading Time: 7 minutesReading Time: 7 minutes The Pros and Cons of a Home Equity Loan in Houston A Houston home-equity loan delivers a lump-sum at a fixed rate—ideal for major renovations or debt consolidation—but it also adds a second lien on your house and must stay under Texas’s strict 80 % combined-LTV cap. Key Takeaways: Should You […]

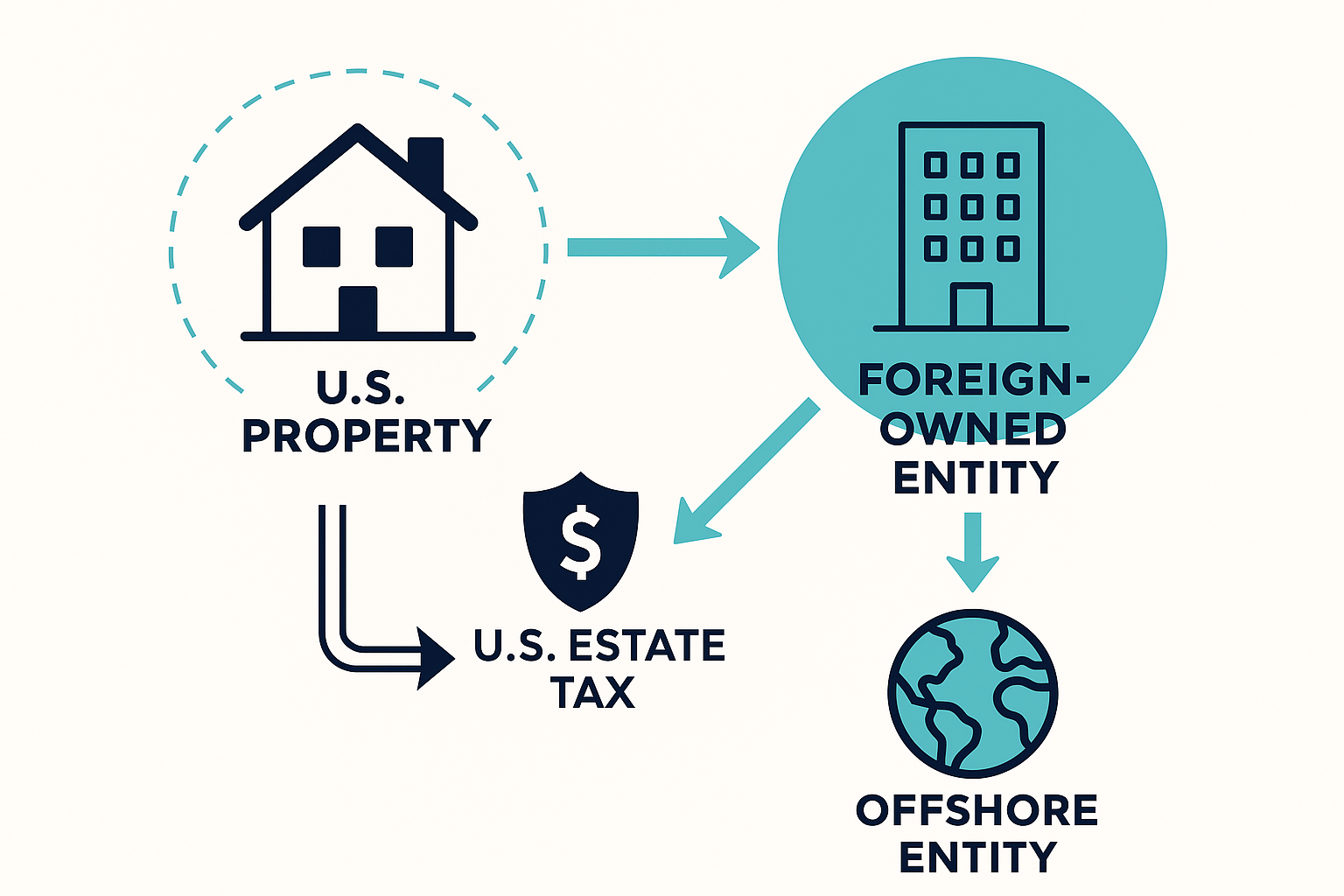

Estate Tax Planning Loophole for Foreign Nationals

Reading Time: 6 minutesReading Time: 6 minutesReading Time: 6 minutes Estate Tax Loophole for Foreign Nationals Estate Tax Loophole planning for nonresident aliens begins with one crucial fact: foreign nationals owe U.S. estate tax only on their U.S.–situs assets—real estate, tangible personal property, and U.S. corporate shares. With just a $60,000 exemption for non-U.S. citizens versus a $13.99 […]

How to Determine the Worth of Your Life Insurance Policy

Reading Time: 5 minutesHow to Determine the Worth of Your Life Insurance Policy Introduction Life insurance often serves as a foundational safety net, protecting loved ones financially in the event of the policyholder’s death. Yet beyond mortality protection, these policies can function as dynamic financial instruments, offering cash-value growth, tax benefits, and strategic flexibility. How to Determine the […]

How Much is Commercial Auto Insurance in Florida?

Reading Time: 4 minutesHow Much is Commercial Auto Insurance in Florida? Running a business in Florida that relies on vehicles comes with its own set of challenges—and commercial auto insurance is one of the most important protections you can put in place. From contractors and delivery drivers to real estate professionals and landscapers, if your vehicle is used […]