Health Insurance Deductibles Explained: How They Work and How to Choose

Quick Insights

Your deductible isn’t just a number—it’s a lever you can pull to take control of your health spending. Set it right, and you keep more of your money while staying protected from the big stuff. Set it wrong, and you’ll either bleed cash monthly or get crushed by one bad bill.

In 2025, High Deductible Health Plans (HDHPs) must meet IRS rules. Pair one with an HSA, and you unlock tax benefits most people leave untouched. Preventive care? Often free when you stay in-network. The system’s rules are public—you just have to play them better.

Author Bio

Hotaling Insurance Services helps people and businesses lock in health plans that protect their cash flow and their health. Read our Complete Guide to Supplemental Life Insurance or call us for a one-on-one review.

Why Deductibles Matter (Way More Than Your Premium)

Most people shop for health plans like they shop for Wi-Fi: find the cheapest monthly payment and call it a day. Big mistake. The deductible dictates how much you’ll really pay when life blindsides you.

-

Set it too high, and a January emergency can wreck your cash flow.

-

Set it too low, and you’ll drip money every month for benefits you barely use.

At Hotaling, we follow one principle: Plan for the year you expect, protect against the year you don’t. That means breaking it down into:

-

Fixed costs (premiums)

-

Variable costs (deductible + coinsurance)

-

The “you’re done now” number (out-of-pocket max)

-

Any tax angles (HSA, FSA) you can use to your advantage

Our independence gives us access to premier carriers like Chubb, Hartford, Travelers, and Nationwide, helping ensure your plan balances cost and protection. Find out how we build the most effective plans at Hotaling Insurance Services.

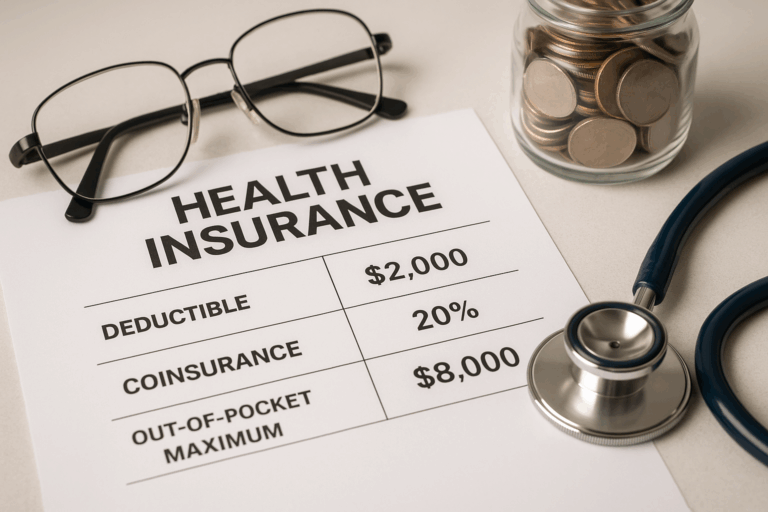

The Key Terms You Need to Understand

| Term | Meaning | 2025 Example |

|---|---|---|

| Premium | Monthly cost to keep your coverage active | $450/month |

| Deductible | What you pay before insurance shares costs | $2,000/year |

| Copay | Flat fee per service | $25 PCP visit |

| Coinsurance | % you pay after meeting your deductible | 20% |

| Out-of-Pocket Max | Annual spending cap for covered, in-network care | ACA and IRS set limits |

Power Move: Preventive care—annual exams, certain screenings—often bypasses the deductible entirely when you’re in-network. That’s free health leverage.

2025 Numbers You Should Have Memorized

For HSA-eligible HDHPs (IRS Rev. Proc. 2024-25):

-

Minimum deductible: $1,650 (self-only) / $3,300 (family)

-

Max out-of-pocket: $8,300 (self-only) / $16,600 (family)

-

HSA limit: $4,300 (self-only) / $8,550 (family) + $1,000 if you’re 55+

Meet these thresholds, and you can use an HSA—a triple tax win most people sleep on.

How Deductibles Work (Real Example)

-

Deductible: $1,500

-

Coinsurance: 20%

-

Out-of-Pocket Maximum (OOP Max): $8,500

-

Procedure Cost: $8,000 (in-network)

Here’s how it breaks down:

Step 1 – Meet the Deductible

You pay the initial $1,500 in full before your insurance shares any costs. This is a standard setup where the insurer doesn’t contribute until you’ve met that threshold.

Step 2 – Split the Remaining Costs via Coinsurance

Of the remaining $6,500, your plan typically covers 80%, leaving you to pay 20%—which is $1,300. This aligns with common coinsurance structures where beneficiaries share costs, often seen in 80/20 plans.

Total Out-of-Pocket for the Procedure: $2,800 (deductible + your coinsurance portion), plus whatever you’ve already spent on premiums.

OOP Max Factor

After this, you’ll continue covering copays or coinsurance on future in-network services until you reach your OOP max—at which point, insurance pays 100% of eligible expenses for the rest of the policy year.

Why This Example Matters

This practical breakdown helps you see how quickly costs can add up—even after the deductible is met. It also underlines why it’s crucial to understand the roles of both the deductible and coinsurance—not just looking at one in isolation but considering how they work together to influence your total healthcare spending.

HDHP vs. Low Deductible Plans — Which Weapon Fits You?

High Deductible Health Plan (HDHP)

Pros:

-

Lower premiums = more cash in your pocket now

-

HSA eligibility (save, invest, and pay medical bills with pre-tax dollars)

-

Perfect for low healthcare use and long-term savings plays

Cons:

-

Higher upfront cost when something happens

-

Requires discipline—fund your HSA or risk getting caught short

Low Deductible Plan

Pros:

-

Predictable costs if you use healthcare a lot

-

Lower financial shock from frequent visits or ongoing conditions

Cons:

-

Higher premiums, even in years you barely use your plan

| Feature | HDHP | Low Deductible |

|---|---|---|

| Premium | Lower | Higher |

| Deductible | Higher | Lower |

| HSA Eligible? | Yes | Usually No |

| Best For | Healthy, low-use | High-use, chronic care |

| Risk | Higher upfront | Lower upfront |

Action Move: If your employer contributes to your HSA, that’s an automatic head start on your deductible.

The Total-Cost Math — Two Real Stories

Healthy Year

-

Premiums: $5,400/year

-

HDHP: Preventive care covered, barely touch deductible → ~$5,400 total

-

Low Deductible: Extra $1,440/year in premiums → ~$6,800–$7,000 total

Winner: HDHP

High-Use Year

-

Premiums: $5,400/year

-

HDHP: Add up to $8,300 → ~$13,700 worst-case

-

Low Deductible: Add up to $9,200 → ~$14,600 worst-case

Winner: HDHP edges out—plus HSA tax perks tip the scale.

Expanded Case Study: Mid-Year Surgery Scenario

Imagine you’ve selected a High Deductible Health Plan (HDHP), with a $2,000 deductible and 20% coinsurance. In July, a knee surgery comes up—a $12,000 procedure.

Step 1 – Meet the Deductible:

The first $2,000 is entirely your responsibility. This is the threshold before cost-sharing begins.

Step 2 – Apply Coinsurance:

Of the remaining $10,000, your insurer pays 80% ($8,000), and you’re on the hook for 20% ($2,000).

Total surgery cost to you: $4,000, plus whatever you’ve already paid in premiums this year.

Now consider if you had a low deductible plan—$750 deductible and 10% coinsurance:

-

You would pay the first $750 in full.

-

Of the remaining $11,250, the insurer covers 90% ($10,125), and you pay $1,125.

-

Total surgery cost: $1,875, plus higher monthly premiums.

Cause & Effect: Although the low deductible plan looks cheaper on paper for this incident, the increased premium—say $120–$150 more per month—totals $1,440–$1,800 extra per year. If this surgery were your only significant event, you may pay more overall under the low deductible plan, despite the lower medical bill.

This underscores why total annual cost—not just deductible size—should be your decision metric. For more context and guidance, revisit our main article: Health Insurance Deductibles Explained: How They Work and How to Choose.

HSA vs. FSA — Which Builds More Muscle?

HSA:

-

Pre-tax in

-

Grows tax-free

-

Tax-free out for medical expenses

-

Rolls over forever

-

Invest it for decades (Fidelity analysis)

FSA:

-

Pre-tax in

-

Must use by year-end (with a small carryover)

-

Covers more than medical in some cases

State-Specific Rules — Don’t Skip This

-

California: Standardized plans; some services never hit the deductible (Covered California 2025 Designs).

-

New York: Some plans cover your first PCP/specialist visit without deductible (NY State of Health).

-

Texas & Florida: Federal Marketplace rules; check issuer fine print.

How to Choose Like a Pro (Step-by-Step Framework)

-

Audit your last 1–2 years — Look at visits, prescriptions, big-ticket events. If you average multiple specialist visits, a low premium/high deductible plan may cost more overall.

-

Run the numbers — Calculate premiums + likely out-of-pocket. Include both fixed and variable costs.

-

Know your cap — Check the out-of-pocket max. It’s your financial ceiling in a worst-case year.

-

Factor in tax tools — HSAs can change the math. Contribute enough to cover your deductible by mid-year.

-

Verify your network — A cheap plan with a bad network will cost more in out-of-network bills.

-

Reassess yearly — Life changes (marriage, kids, new job) should trigger a plan review.

Avoid These Rookie Mistakes

-

Buying on premium alone — You may save monthly but overpay yearly if you have one big event.

-

Ignoring free preventive care — Skipping it risks bigger bills later.

-

Assuming all high deductibles are HSA-eligible — Check IRS criteria first.

-

Skipping employer HSA contributions — That’s free money you’re losing.

-

Forgetting out-of-network costs — Some plans have separate, higher deductibles or no cap at all.

Additional Niche Insights (All Provable)

-

Maternity care — Deductible met or not can change delivery costs (Healthcare.gov).

-

Specialty drugs — Often subject to the medical deductible (CMS).

-

IRS vs ACA OOP caps — HDHP caps are lower than ACA caps.

-

HSA investment strategy — Grows tax-free over decades (Fidelity).

-

State plan designs — CA/NY differ from federal standards.

-

Preventive leverage — Annual exams and many screenings are $0 in-network.

-

Mental health parity — Coverage must match medical care rules (DOL).

FAQs — Fast Answers

Does preventive care count toward my deductible?

No — most in-network preventive services are fully covered and do not apply toward your deductible. These services—like annual physicals, screenings, and immunizations—are designed to keep you healthy while preventing extra costs. In fact, plans are required under the ACA to cover them at no cost.

Do deductibles reset annually?

Yes, almost always. Most health plans follow a calendar-year reset, meaning your deductible resets on January 1. Some employer plans may follow a different plan year reset, so always check your plan details to avoid surprises.

Can families share a deductible?

Many family plans feature both individual and family deductibles. You might meet an individual deductible parts of the family reach the overall family deductible, or vice versa—rules vary based on plan structure. It’s best to review your policy’s Summary of Benefits & Coverage to understand how your plan handles this.

What’s the difference between the ACA out-of-pocket max and the IRS HDHP cap?

ACA sets maximums for all Marketplace plans—for 2025, that’s $9,200 (individual) and $18,400 (family). The IRS caps apply to HDHPs and are slightly lower: $8,300 (individual) and $16,600 (family).

Do I need an HSA with an HDHP?

No, an HSA isn’t required—but it’s highly recommended. Pairing an HDHP with an HSA unlocks triple-tax advantages: tax-deductible contributions, tax-free growth, and tax-free withdrawals for medical expenses. A powerful combination for savings and long-term planning.

Conclusion: Your Next Move

Choosing the right deductible isn’t about luck—it’s about building a plan that works when you’re healthy and when you’re not.

Let’s run your numbers side-by-side, factor in tax plays, and set you up to win 2025.

Talk to Hotaling Insurance Services — we’ll make the math make sense.